[ad_1]

The records keep tumbling. The Nasdaq Composite

COMP

has joined the S&P 500

SPX

in securing a new high. Early Friday futures suggest a marginal dip from those levels at the opening bell.

The S&P 500 has risen four months in a row, gaining 21.5%, its best four-month advance since July 2020, according to Dow Jones Market Data.

But that’s the sort of momentum that gets some market observers twitchy. Bearish traders of a technical bent portentously tap their computer screens to highlight the warnings being flashed by their favorite momentum gauge: the 14-day relative strength index, or RSI.

However, Mark Newton, head of technical strategy at Fundstrat, says that though many RSI readings are elevated it does does not mean stocks currently are vulnerable.

Before we explain Newton’s thinking, let’s examine RSI a bit more. Having a rising RSI is a positive signal for a stock, for it shows buying momentum is picking up, relative to selling. A falling RSI is the opposite and is bad for those long of a stock.

But RSI becomes most useful as a short-term contrarian indicator at extremes. If the RSI has surged very high it suggests the market is getting too excited and a reversal may be due. That overbought threshold is placed at an RSI of 70, according to most market technicians. An oversold RSI is below 30.

It should be noted that not all RSI are equal. One difference is that smaller cap stocks (which are more vulnerable to retail investor herding) that also have a high beta (they normally move more than the underlying market) can more easily reach the RSI extremes.

And Newton notes another difference: that overbought territory is different between daily, weekly and monthly charts. Shorter-term traders can claim markets or individual stocks are overbought when daily indicators like the traditional 14-day RSI move above 70. Longer-term investors may focus on the weekly and/or monthly RSI.

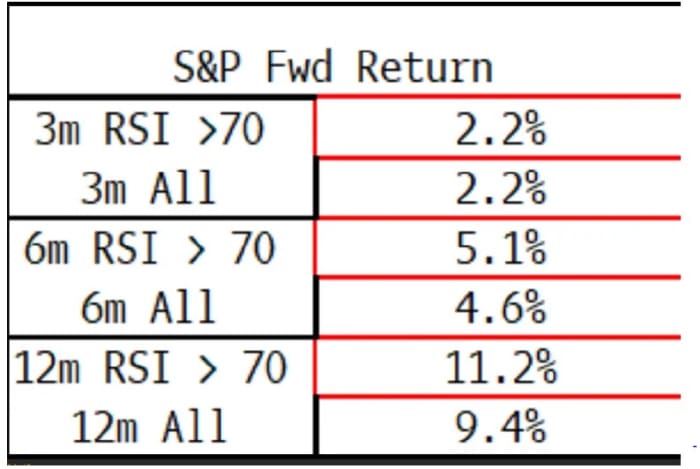

In essence, Newton shows in the table below that a pullback in say the S&P 500 members because daily RSI became overbought is likely to be short-term and that the upward trend can then be resumed.

“Over a three, six, and 12 month basis, when SPX constituents have climbed over 70%, gains have largely mirrored the percentages when RSI is under 70. Thus, being overbought in and of itself, does not seem to be a hurdle towards further gains,” says Newton.

Source: Fundstrat

The good news for index-tracking traders is that neither the Nasdaq Composite on 62.6 or the S&P 500 on 66.9 have RSI in overbought territory. Germany’s DAX

DX:DAX

on 77.6 and Japan’s Nikkei 225

JP:NIK

on 81.2 do look vulnerable to, at least, a short-term pullback.

And to show how useful as a short-term contrarian indicator the RSI can be, consider Super Micro Computer

SMCI,

Fired up by AI-related frenzy and option buying by the Wallstreetbets crowd, shares in the computer-server provider rose way above $1,000 on Feb. 16, pushing its RSI to more than 98. Buying at such an extreme overbought level was a very bad move that day with the shares finishing the session about 25% lower from the peak.

Markets

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

AMD, |

Advanced Micro Devices |

|

SOUN, |

SoundHound AI |

|

PLUG, |

Plug Power |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

MARA, |

Marathon Digital |

|

PLTR, |

Palantir Technologies |

Random reads

Bike vigilantes.

A very small frog.

The Devil’s playground.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

[ad_2]

Source link