A record number of people in the U.S. will turn 65 this year. Here’s how the phenomenon known as Peak 65 can affect you, even if you are not close to that age.

Beth Pinsker interviews a woman who will turn 65 in June but began worrying about retirement finances back in 1981. Here’s what she learned and what she is focusing on now.

Jessica Hall interviews another woman who turns 65 this year and is finding her second, part-time career much more fulfilling than her first one.

Read on: Medicare, and other pitfalls of turning 65

Help with finances before and during retirement

A win by which team would be a better indicator for the stock market’s performance?

Getty Images

Just in time for the big game, Mark Hulbert looks back to see how well a “Super Bowl Indicator” has predicted the movement of the stock market.

Hulbert also looks at Fortune’s list of the “world’s most admired companies” to see how much this coveted ranking correlates to the movement of stock prices. The results of his analysis may surprise you.

Diving for dividend stocks

When investors consider dividend-paying stocks, they might begin by looking at the ones with the highest dividend yields. But there’s another approach that may be a better for building a lucrative income stream over the long term.

More: Is Meta now a value stock?

This could be a less expensive way for investors to make money from the weight-loss-drug craze

Speculative investors might find a greater reward, with more risk, with shares of Viking Therapeutics as a play on the GLP-1 weight-loss-drug craze.

MarketWatch/Viking Therapeutics

Shares of Elli Lilly & Co.

LLY,

the maker of Mounjaro, a GLP-1 weight-loss drug, have more than doubled over the past year and trade for 56.4 times the consensus earnings-per-share estimate over the next 12 months, among analysts polled by FactSet. In comparison, the S&P 500 trades for a weighted 20.4 times its forward EPS estimate.

American depositary receipts of rival Novo Nordisk A/S

NVO,

which makes Wegovy and Ozempic, have returned 71% over the past year and now trade at a forward price-to-earnings ratio of 35.

Among analysts polled by FactSet, 74% rate Eli Lilly a buy or the equivalent, but their consensus price target of $740.79 was only 1% above the stock’s closing price of $735.68 on Thursday. For Novo Nordisk, 60% of analysts have buy ratings on the ADR, and their price target of $116.17 was slightly below Thursday’s closing price of $118.39.

So the analysts like the companies but believe their stocks are fully valued, at least for the next year.

Ciara Linnane explains why analysts are in love with Viking Therapeutics Inc.

VKTX,

which has moved up the schedule for trials of its own GLP-1 receptor agonist medication. All 10 analysts covering the company who were polled by FactSet rate the stock a buy, and their consensus price target of $36.33 was 26% above Thursday’s closing price of $28.89.

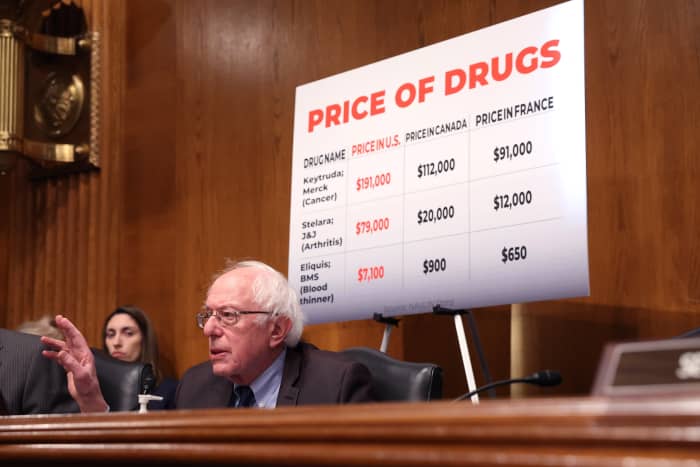

Drugmakers deflect blame to middlemen for high prices

Sen. Bernie Sanders had a bone to pick with large drug manufacturers on Thursday.

Getty Images

During a Senate Health, Education, Labor and Pensions Committee hearing on Thursday, Sen. Bernie Sanders, the Vermont independent, and others grilled the chief executives of Johnson & Johnson

JNJ,

Merck & Co.

MRK,

and Bristol Myers Squibb Co.

BMY,

about high drug prices. The CEOs pushed back with numbers to place blame elsewhere, as Eleanor Laise reports.

More biotech and pharmaceutical coverage:

A new market for tech workers

Support groups on LinkedIn are growing for workers displaced as technology companies lay off thousands.

WALL STREET JOURNAL, GETTY IMAGES

James Rogers covers a difficult subject — mounting layoffs by technology companies — and reports on the new support groups that are helping people find new jobs.

More from James Rogers:

Big moves for homeowners

Aarthi Swaminathan writes the Big Move column to help readers with complicated real-estate questions. This week she addresses two difficult scenarios:

- My mother, 87, has $425,000 left on a home worth $1 million. How can I settle her debts when she passes? Should I take out a reverse mortgage?

- ‘I’m dipping into my Roth IRA’: I’ve been unemployed for five months. I used to earn $10,000 a month. Do I sell my house?

NYCB’s stock slide reverses

MarketWatch illustration

We all might prefer to steer clear of difficult questions about money from friends and family. Quentin Fottrell — the Moneyist — does the opposite:

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.