When Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett speaks, the whole of Wall Street pays close attention. Delivering an aggregate return of more than 5,180,000% in Berkshire’s Class A shares (BRK.A) since becoming CEO in 1965, and effectively doubling up the annualized total return of the broad-based S&P 500 spanning almost six decades, has garnered Buffett quite the following.

In particular, investors typically wait on the edge of their seat for clues as to what the affably named “Oracle of Omaha” has been buying or selling. These “clues” can be divulged when:

-

Berkshire Hathaway files its quarterly Form 13F with the Securities and Exchange Commission — a 13F is a snapshot of what Wall Street’s top money managers have been buying and selling.

-

The company lifts the proverbial hood on its quarterly operating results.

-

Buffett releases his annual letter to shareholders.

-

Buffett speaks candidly with investors during Berkshire’s annual shareholder meeting.

The release of Berkshire’s second-quarter operating results on August 3 offered a big clue as to what the Oracle of Omaha and his trusted investment advisors, Todd Combs and Ted Weschler, have been up to. More specifically, it revealed an unprecedented level of selling activity in the company’s 44-stock investment portfolio.

Buffett and his team have been net-sellers of equities since October 2022

Let me preface this discussion by making one thing clear: Warren Buffett is a long-term optimist on the U.S. economy and stock market. On numerous occasions throughout his tenure as CEO, he’s spoken about the strength of the U.S. economy and the value of patience.

But just because he’s a long-term optimist, it doesn’t mean he’ll overpay for time-tested businesses.

During the June quarter, Berkshire Hathaway’s consolidated cash flow statements show only $1.615 billion in equity security purchases — some of which is tied to the company’s continued purchase of Occidental Petroleum stock.

Comparatively, Buffett and his top aides oversaw the sale of $77.151 billion of equity securities. The lion’s share of this selling activity is tied to Berkshire’s largest position, Apple (NASDAQ: AAPL). The $84.2 billion fair value estimate for Berkshire’s stake in Apple, as of June 30, implies that nearly half of the company’s holdings in the tech stalwart were disposed of during the second quarter. This follows the sale of more than 116 million shares of Apple in the first three months of 2024.

Altogether, $75.536 billion in net equities were sold in the second quarter, which is the most Berkshire Hathaway has ever sold in a single quarter.

Furthermore, it marks the seventh consecutive quarter that Buffett and Co. have sold more securities than they’ve purchased:

In aggregate, $131.63 billion in net-equity sales have been undertaken since Oct. 1, 2022.

Warren Buffett’s $132 billion warning has become deafening

To be fair, Warren Buffett has a logical scapegoat to justify Berkshire’s record-breaking selling activity. During his company’s annual shareholder meeting in May, the Oracle of Omaha opined that corporate tax rates were likely headed higher in the future. Thus, locking in some profits at a historically lower corporate tax rate would, in hindsight, be viewed favorably by his company’s shareholders.

While it’s possible the extraordinary selling activity we’ve witnessed in Apple, and more recently Bank of America, is tax-based, the more likely explanation is that Buffett’s roughly $132 billion in net-equity sales is a silent, yet deafening, warning for Wall Street.

Although Buffett would never bet against America — i.e., you’ll never seen him buying put options or short-selling stocks — he’s not been shy about holstering his cash when value is few and far between on Wall Street. In other words, the long-term mantra the Oracle of Omaha preaches doesn’t always align with his actions over shorter timelines.

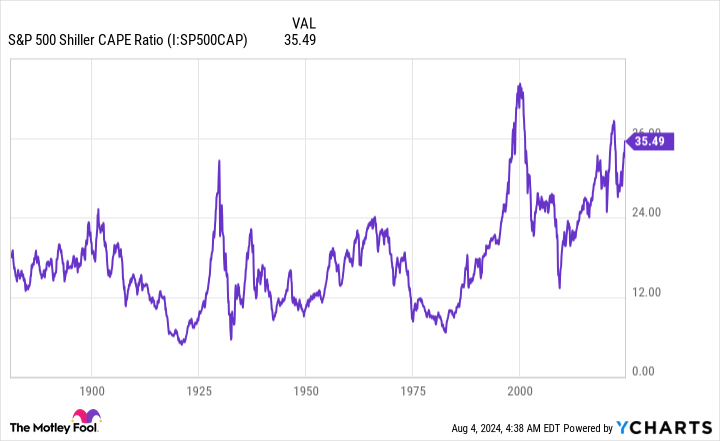

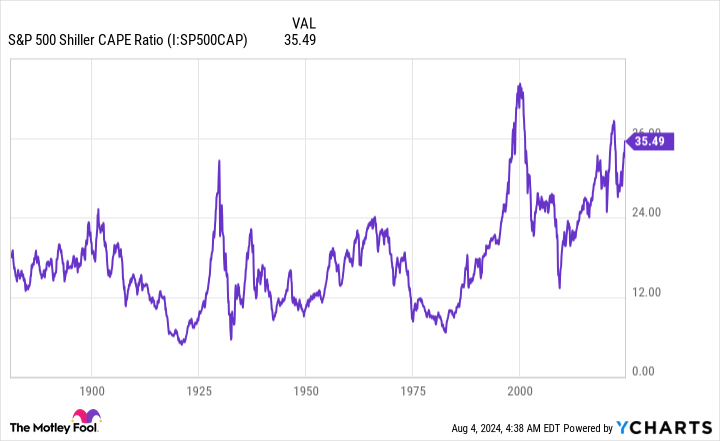

If there’s a valuation model that demonstrates just how pricey stocks are right now, it’s the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also commonly referred to as the cyclically adjusted price-to-earnings ratio, or Cape ratio.

Unlike the traditional P/E ratio, which divides a company’s share price into its trailing-12-month earnings per share and is easily the most-popular valuation metric, the Shiller P/E is based on average inflation-adjusted earnings from the prior 10 years. Examining a decade’s worth of earnings history helps to smooth out one-off events that can adversely impact traditional valuation models.

As of the closing bell on August 2, the S&P 500’s Shiller P/E stood at 34.48. This is down modestly from a peak of 37 in recent weeks, but still represents one of the highest readings we’ve observed during a bull market rally, when back-tested to 1871!

Including the present, there have only been a half-dozen occasions in more than 150 years where the Shiller P/E ratio has topped 30 during a bull market. The previous five instances were all followed by plunges of 20% to 89% for Wall Street’s major stock indexes.

Though the Shiller P/E isn’t a timing tool and won’t help investors decipher when stock market corrections will begin, it does have a flawless track record of eventually forecasting major downside in the stock market.

Buffett wants no part of the “casino,” but will pounce when the time is right

The unprecedented selling activity we’ve witnessed from Buffett and his team through the first-half of the year was, arguably, telegraphed in February by the Oracle of Omaha himself. In his annual letter to shareholders, he spoke candidly about the dangers of “casino-like behavior” on Wall Street:

Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

This is another instance of Buffett warning investors of the dangers of irrational exuberance on Wall Street without (key word!) telling investors to sell their stock or avoid the market altogether.

But what Buffett does have working in his and his company’s favor is the ability to respond to large-scale market opportunities when the pendulum swings in the other direction. Nabbing a sizable stake in Bank of America (via preferred stock, initially) in 2011 following the financial crisis is just one example of how Berkshire’s investment team has used its treasure chest to take advantage of short-lived periods of fear on Wall Street.

Following a quarter that featured historic levels of equity sales, Berkshire’s cash pile, which includes cash equivalents and U.S. Treasuries, hit an all-time high of $277 billion. The options available to Buffett and his top aides are seemingly limitless.

If history has taught us anything, it’s that Warren Buffett will deploy Berkshire Hathaway’s cash hoard when wonderful businesses are trading at fair prices. Although it could be some time before we see this capital put to work, Buffett’s long-term faith in the American economy and stock market remains unwavering.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett’s Unprecedented $132 Billion Warning to Wall Street Can’t Be Ignored Any Longer was originally published by The Motley Fool