Analog Devices (NASDAQ: ADI) isn’t as well-known in the semiconductor industry as major players like Nvidia or Taiwan Semiconductor, which are riding the fast-growing adoption of artificial intelligence (AI) and reporting eye-popping growth. That explains why shares of the chipmaker are up just 12% year to date, lagging the stunning gains recorded by some of its peers and the semiconductor sector overall.

However, a closer look at the company’s latest quarterly results and management’s commentary indicates the chipmaker is on the verge of a turnaround. With its offerings used in various end markets, including the industrial, automotive, consumer, and aerospace and defense industries, among others, buying this semiconductor stock right now could be a smart thing to do from a long-term perspective.

Analog Devices is struggling, but there are signs of a revival

Analog Devices released its fiscal 2024 third-quarter results (for the three months ended Aug. 3) last month. The company’s revenue fell 25% year over year to $2.31 billion, while non-GAAP earnings were down 37% from the same quarter last year to $1.58 per share.

The chipmaker’s poor year-over-year comparisons can be attributed to weak demand across almost all of its end markets. The industrial business, for example, is Analog’s largest segment and accounts for 46% of its top line. It witnessed a 37% year over year contraction in revenue. That’s not surprising as this segment is still reeling from the impact of the oversupply caused by poor demand last year.

More specifically, the global semiconductor industry’s revenue was down 11% in 2024 as demand remained weak for smartphones, personal computers, and data centers. Although AI has emerged as a savior for the semiconductor industry in the past year, Analog Devices hasn’t been able to ride this trend since it doesn’t make graphics processing units (GPUs) like Nvidia and AMD.

However, management points out that its performance in the previous quarter was better than expected, and the end markets it serves could soon start recovering.

For guidance, Analog Devices is projecting $2.30 billion to $2.50 billion in revenue in the current quarter with adjusted earnings of $1.53 to $1.73 per share. The company’s revenue stood at $2.72 billion in the same quarter last year, so Analog’s year-over-year revenue decline is set to slow to 11% in the current quarter. The pace of decline on its bottom line should slow as well.

These are indications the inventory correction in Analog Devices’ end markets could be nearing an end. CEO Vincent Roche remarked on the latest earnings call that “improved customer inventory levels and order momentum across most of our markets increased my confidence that our second quarter marks the cyclical bottom for ADI.”

A potential recovery could lead to more stock upside

Consensus estimates indicate Analog Devices’ revenue will decline 24% in fiscal 2024 to $9.38 billion, while its earnings are on track to drop to $6.33 per share from $10.09 per share in the previous fiscal year. However, fiscal 2025 should see a rebound with revenue up 10% to $10.35 billion, while its bottom line could increase by almost 20% to $7.57 per share.

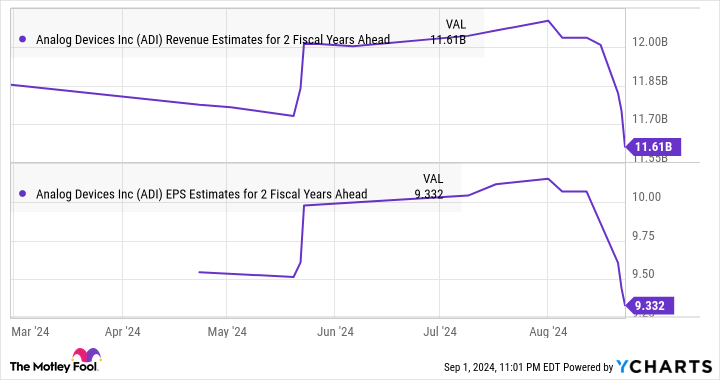

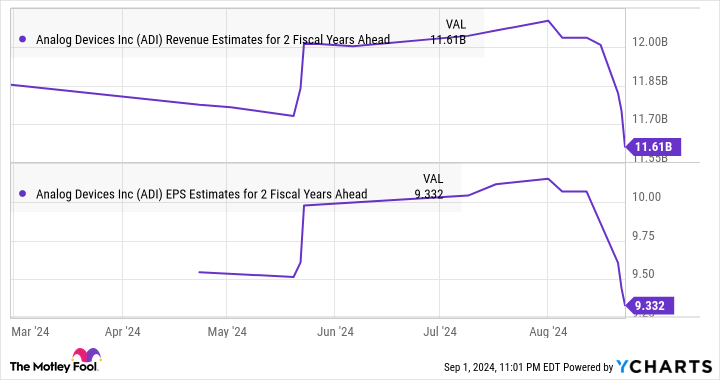

Though analysts have tempered their expectations for fiscal 2026, they’re still forecasting an acceleration in Analog’s top- and bottom-line growth, as we can see in the chart below:

Those estimates can still move higher if Analog Devices’ financial performance improves on the back of a recovery in its end markets. That’s why there’s a good chance this chipmaker could step on the gas and deliver more gains over the next couple of years.

Should you invest $1,000 in Analog Devices right now?

Before you buy stock in Analog Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Analog Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Up 12% in 2024, You May Want to Buy This Semiconductor Stock Before It Goes on a Bull Run was originally published by The Motley Fool