The Indian market has climbed 1.1% over the last week and is up an impressive 42% over the last 12 months, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying promising stocks that are still under the radar can offer significant opportunities for investors looking to capitalize on growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In India

|

Name |

Debt To Equity |

Revenue Growth |

Earnings Growth |

Health Rating |

|---|---|---|---|---|

|

3B Blackbio Dx |

0.38% |

-0.26% |

-1.39% |

★★★★★★ |

|

ELANTAS Beck India |

NA |

14.89% |

24.83% |

★★★★★★ |

|

Om Infra |

13.99% |

43.36% |

27.64% |

★★★★★☆ |

|

Pearl Global Industries |

72.24% |

19.89% |

41.91% |

★★★★★☆ |

|

Indo Amines |

82.32% |

17.15% |

20.00% |

★★★★★☆ |

|

Nibe |

33.91% |

80.77% |

84.68% |

★★★★★☆ |

|

Lotus Chocolate |

13.51% |

28.07% |

-10.66% |

★★★★★☆ |

|

BLS E-Services |

1.67% |

15.04% |

51.58% |

★★★★★☆ |

|

Monarch Networth Capital |

32.66% |

30.99% |

50.24% |

★★★★☆☆ |

|

Share India Securities |

24.23% |

37.66% |

48.98% |

★★★★☆☆ |

Click here to see the full list of 445 stocks from our Indian Undiscovered Gems With Strong Fundamentals screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Value Rating: ★★★★★☆

Overview: Gallantt Ispat Limited engages in the manufacture of iron and steel in India and internationally, with a market cap of ₹86.89 billion.

Operations: Gallantt Ispat generates revenue primarily from the manufacture of iron and steel products. The company’s cost structure includes expenses related to raw materials, labor, and manufacturing processes.

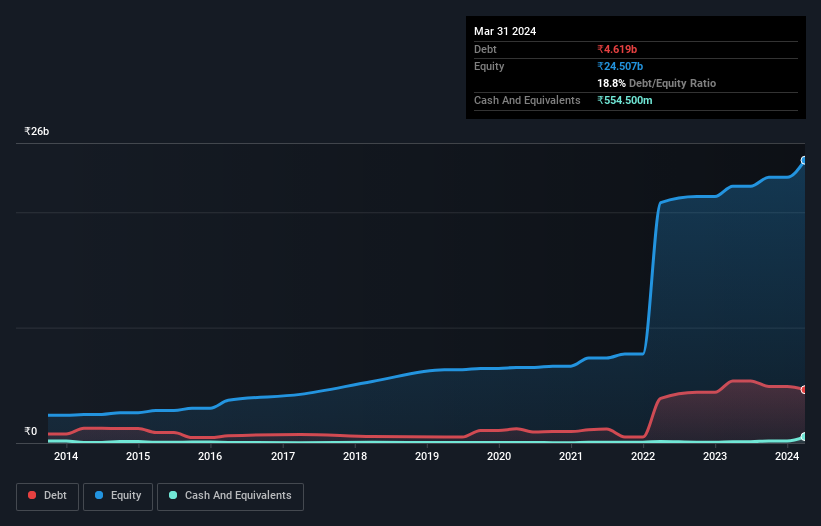

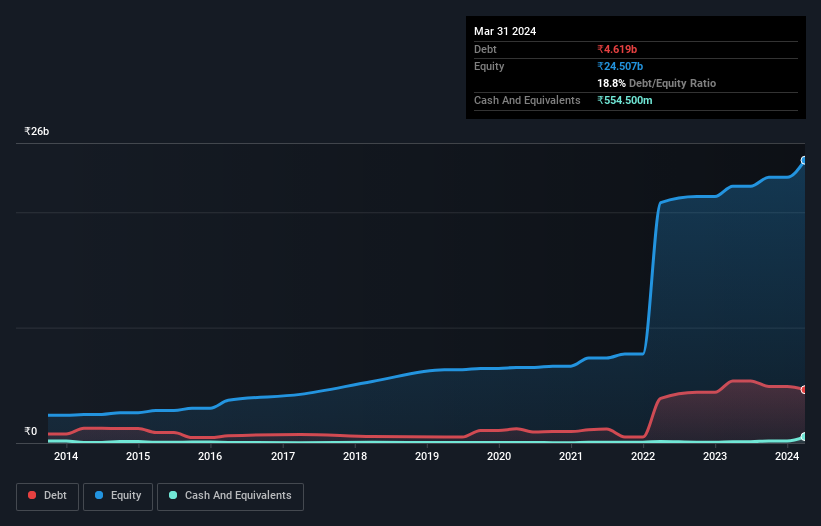

Gallantt Ispat, a small cap in the metals and mining sector, reported impressive earnings growth of 115.2% over the past year, outpacing the industry’s 18.4%. The company’s net debt to equity ratio stands at a satisfactory 16.6%, with EBIT covering interest payments 16.8 times over. Recent results show sales of ₹11.60 billion and net income of ₹1.22 billion for Q1 2024, compared to ₹10.37 billion and ₹307 million last year respectively, reflecting strong performance momentum.

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market cap of ₹65.41 billion.

Operations: Gulf Oil Lubricants India Limited generates revenue primarily from the sale of lubricants, amounting to ₹33.83 billion.

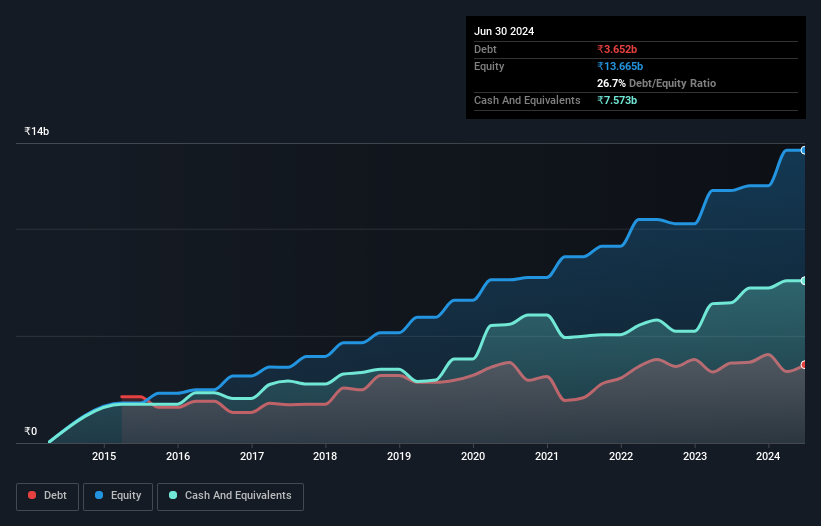

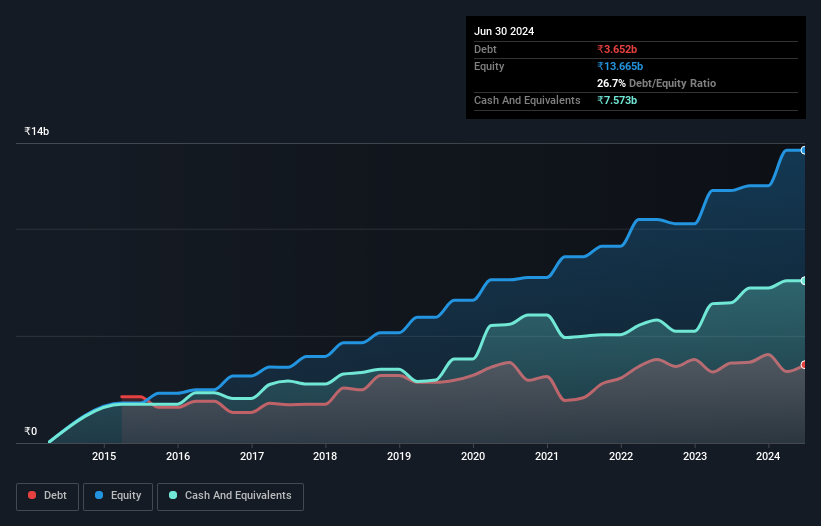

Gulf Oil Lubricants India has shown robust earnings growth, with a 33% increase over the past year, significantly outpacing the Chemicals industry’s 7.5%. The company’s debt-to-equity ratio improved from 48.3% to 26.7% in five years, reflecting better financial health. Additionally, its price-to-earnings ratio of 20.1x is attractive compared to the Indian market’s average of 33.2x. Recent executive changes include appointing Sandeep Bangia as Head of Strategy and E-Mobility, which could drive future growth.

Simply Wall St Value Rating: ★★★★★★

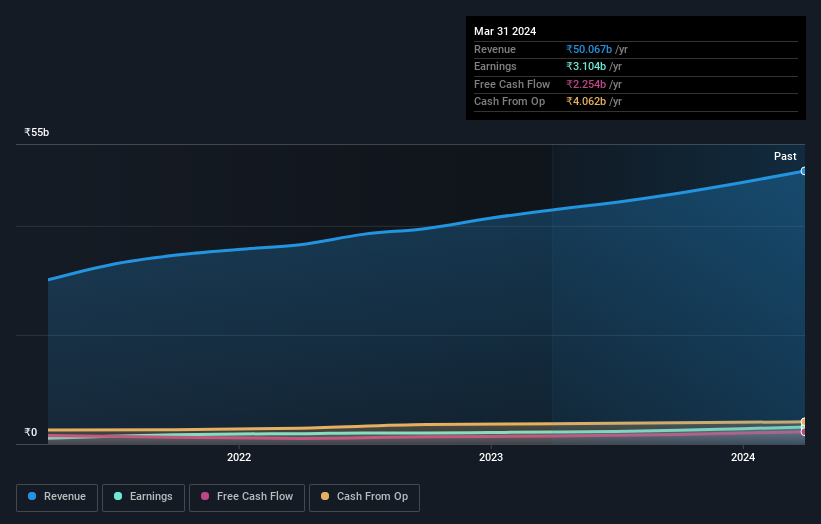

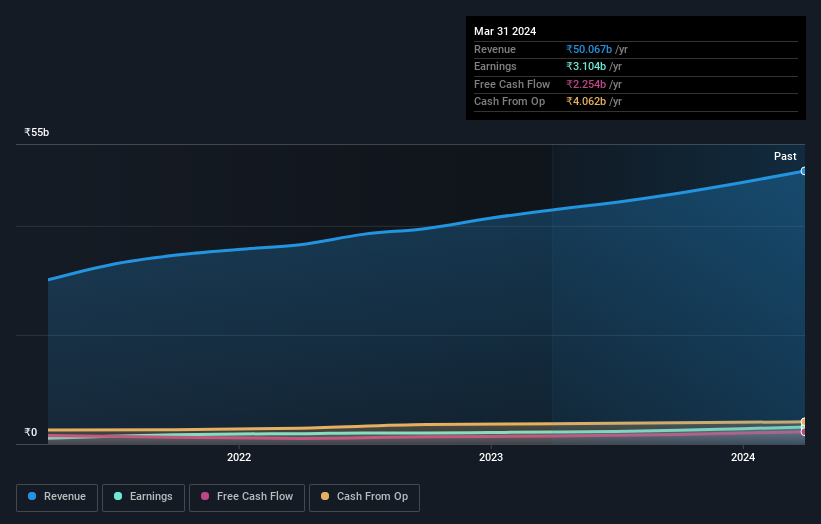

Overview: Time Technoplast Limited, along with its subsidiaries, manufactures and sells a variety of technology-based polymer and composite products in India and internationally, with a market cap of ₹78.63 billion.

Operations: Time Technoplast generates revenue primarily through the sale of polymer and composite products. The company reported a market cap of ₹78.63 billion.

Time Technoplast has demonstrated robust earnings growth of 44.6% over the past year, significantly outpacing the Packaging industry’s 3.3%. The company reported net income of ₹793.1 million for Q1 2024, up from ₹560.9 million a year ago, with basic earnings per share increasing to ₹3.49 from ₹2.48. With a net debt to equity ratio of 25.9%, it maintains satisfactory leverage levels and has seen its debt to equity ratio decrease from 49% to 31.7% over five years.

Next Steps

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GALLANTT NSEI:GULFOILLUB and NSEI:TIMETECHNO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com