For much of the past 19 months, professional and everyday investors have enjoyed a hair-raising bull market rally. Since the start of 2023, the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), broad-based S&P 500 (SNPINDEX: ^GSPC), and growth-propelled Nasdaq Composite (NASDAQINDEX: ^IXIC) have rocketed higher by 22%, 42%, and 64%, respectively, as of the closing bell on Aug. 1.

Although history has repeatedly shown that all three major indexes increase in value over long periods, correctly forecasting what Wall Street will do over the next couple of weeks, months, or quarters is virtually impossible with any sustained accuracy. Nevertheless, it doesn’t stop the investing community from trying to do the impossible.

Even though no economic data point or metric can definitively predict directional short-term moves in the Dow Jones, S&P 500, and Nasdaq Composite, a small number of figures have historically correlated with big moves higher or lower in the major stock indexes.

At the moment, we’re witnessing history from one of these metrics, which appears to portend trouble to come for the U.S. economy and stocks.

U.S. money supply hasn’t done this since the early to mid-1930s

While there are a couple of truly troublesome predictive indicators at the moment, such as the lengthiest yield-curve inversion in history and one of the highest S&P 500 Shiller price-to-earnings ratio readings dating back to the early 1870s, it’s the change we’ve witnessed in U.S. money supply that should have investors’ undivided attention.

Of the five money supply metrics, the two that receive the most attention are M1 and M2. M1 takes into account all cash and coins in circulation, along with demand deposits in a checking account. It’s effectively money that can be spent at the drop of a hat.

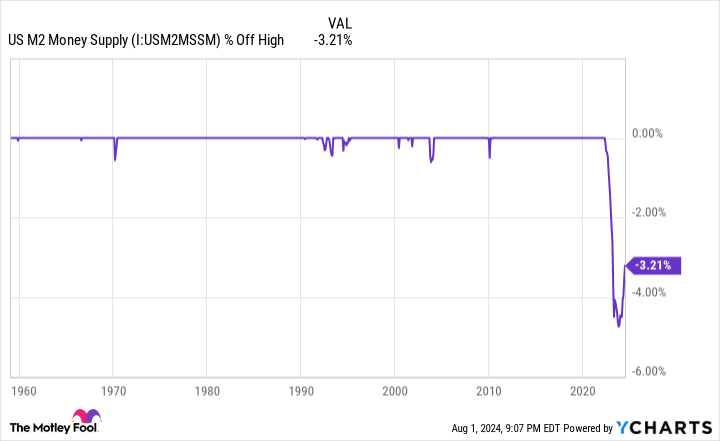

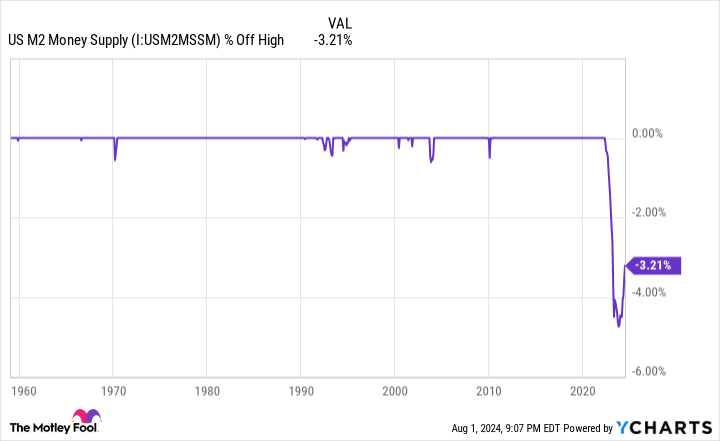

Comparatively, M2 money supply factors in everything from M1 and adds savings accounts, money market accounts, and certificates of deposit (CDs) below $100,000. We’re still talking about money consumers can spend, but it requires more effort to access. It’s this category of money supply (M2) that’s ringing alarm bells.

For the previous nine decades, economists and investors paid little attention to M2 money supply for one reason: It never had any notable declines. A steadily growing economy requires more capital in circulation to facilitate transactions. Likewise, when the U.S. economy stumbled during recessions or periods of financial crisis, the nation’s central bank or federal government was there to provide an injection of capital, if necessary.

But in those unusual instances when the M2 money supply meaningfully declines from its all-time high, it’s spelled big-time trouble for the U.S. economy and Wall Street.

In April 2022, M2 hit an all-time high of $21.722 trillion, based on monthly reported data from the Board of Governors of the Federal Reserve. But as of June 2024, M2 stood at $21.025 trillion, representing an aggregate decline of 3.21%. Though this is off its peak decline of 4.74%, set in October 2023, it’s nevertheless the first cumulative drop of at least 2% in M2 since the Great Depression.

To be completely fair, this drop isn’t as cut-and-dried as I’ve made it out to be. The aforementioned peak drop of 4.74% followed a record 26% year-over-year expansion of U.S. M2 money supply during the height of the COVID-19 pandemic. A relatively modest decline in M2 following a historic expansion of the money supply may represent nothing more than a reversion to the mean.

Adding to this point, M2 is actually growing, once again, on a year-over-year basis. Although it remains 3.21% below its all-time high, the June 2024 M2 money supply data shows a 1.11% year-over-year increase.

While it’s possible the historic move we witnessed in M2 was nothing more than a reaction to its record-breaking expansion during the pandemic, history suggests something more sinister may await.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

As you can see in the post above from Reventure Consulting CEO Nick Gerli on X (the platform formerly known as Twitter), year-over-year declines of at least 2% in U.S. M2 money supply are quite rare. There have been only five instances spanning 154 years where M2 fell by 2% (or more) on a year-over-year basis: 1878, 1893, 1921, 1931-1933, and 2023.

All four prior instances of a 2% or greater drop in year-over-year M2 money supply correlated with economic depressions and periods of double-digit unemployment for the U.S. economy. Even though the U.S. economy and stock market aren’t tethered at the hip, weakness in the economy would be expected to adversely impact corporate earnings and push stocks lower.

The main concern here is that if the M2 money supply has, in aggregate, notably declined since April 2022, there’s less capital for the discretionary purchases that have fueled the current economic expansion and bull market on Wall Street. Consumers paring back their spending is a key catalyst for recessions.

Perspective is paramount when investing on Wall Street

As much as investors might dislike the idea that a stock market correction, bear market, or even crash may await Wall Street, these are normal and inevitable aspects of the investing cycle. What’s far more important is the ability for investors to step back and gain perspective.

For example, recessions are just as much a part of the economic cycle as periods of expansion. But investors who are able to widen their lens will note that these cycles aren’t linear. This is to say that most recessions since the end of World War II have resolved in under a year.

Comparatively, the vast majority of economic expansions have endured for multiple years, including two that lasted for more than a decade. Investors who position their portfolios to take advantage of long-winded periods of growth, even without knowing when these upswings will begin, tend to be successful over the long run.

This disparity between the length of economic expansions and contractions also plays out on Wall Street.

In June 2023, when the bull market for the S&P 500 was officially brand-new, Bespoke Investment Group released the data set you see above, which compared the length of every bear and bull market in the benchmark index since the start of the Great Depression in September 1929.

As you’ll note, the average S&P 500 bear market has stuck around for only 286 calendar days, or about 9.5 months. Meanwhile, the typical bull market over this 94-year stretch lasted 1,011 calendar days, or 3.5 times longer than the average S&P 500 bear market.

A separate study updated earlier this year by Crestmont Research further validates the importance of perspective and patience on Wall Street.

The analysts at Crestmont calculated the rolling 20-year total returns (including dividends paid) for the S&P 500 dating back to the start of the 20th century. Even though the S&P didn’t come into existence until 1923, its components could be found in other indexes prior to this point, which allowed Crestmont to back-test its returns data to 1900. Doing so provided 105 rolling 20-year periods of return data (1919-2023).

What this data set showed was that if an investor, hypothetically speaking, had purchased an S&P 500 tracking index at any point since 1900 and simply held it for 20 years, they made money, without fail, every time — 105 out of 105. In fact, roughly half of the rolling 20-year periods examined would have yielded a 9% or greater annualized return.

No matter how grim a predictive indicator, data set, or metric might be in the short run, it can’t hold a candle to what patience and perspective have provided for investors over the long term.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $18,910!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,544!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $330,931!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of July 29, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

U.S. Money Supply Has Done Something So Unusual That It Hasn’t Happened Since the Great Depression — and a Big Move in Stocks May Await was originally published by The Motley Fool