With the Canadian TSX up over 5% and positive market sentiment returning, investors are keenly watching how the Bank of Canada’s interest rate decisions will shape future opportunities. Amidst this backdrop, dividend stocks can offer a reliable income stream and stability for portfolios.

Top 10 Dividend Stocks In Canada

|

Name |

Dividend Yield |

Dividend Rating |

|

Bank of Nova Scotia (TSX:BNS) |

6.57% |

★★★★★★ |

|

Whitecap Resources (TSX:WCP) |

7.00% |

★★★★★★ |

|

Secure Energy Services (TSX:SES) |

3.34% |

★★★★★☆ |

|

Labrador Iron Ore Royalty (TSX:LIF) |

8.51% |

★★★★★☆ |

|

Enghouse Systems (TSX:ENGH) |

3.45% |

★★★★★☆ |

|

Firm Capital Mortgage Investment (TSX:FC) |

8.75% |

★★★★★☆ |

|

Russel Metals (TSX:RUS) |

4.41% |

★★★★★☆ |

|

iA Financial (TSX:IAG) |

3.29% |

★★★★★☆ |

|

Royal Bank of Canada (TSX:RY) |

3.71% |

★★★★★☆ |

|

Canadian Natural Resources (TSX:CNQ) |

4.20% |

★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

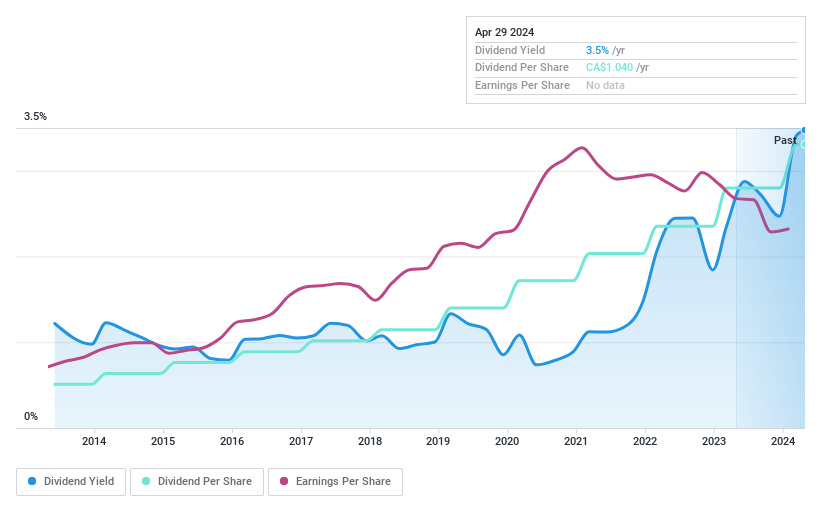

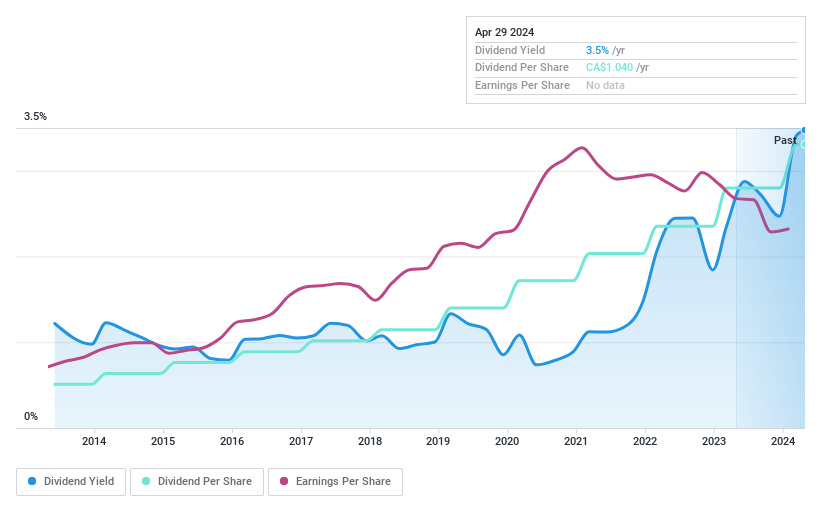

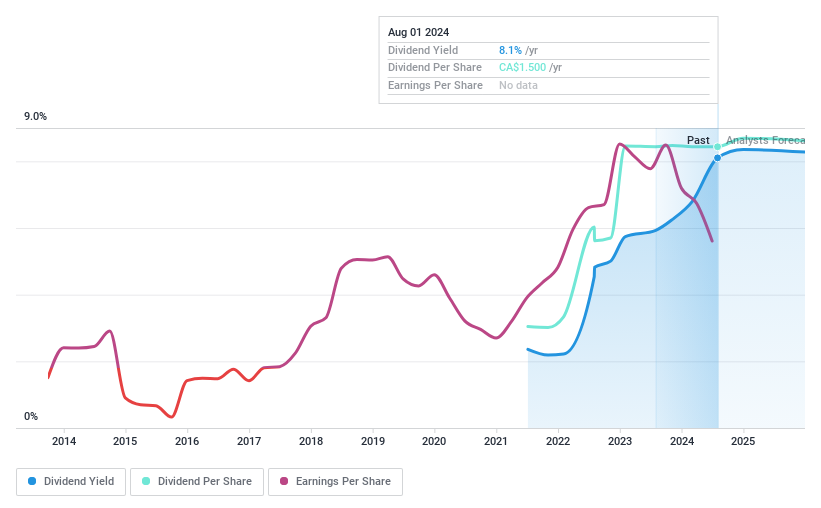

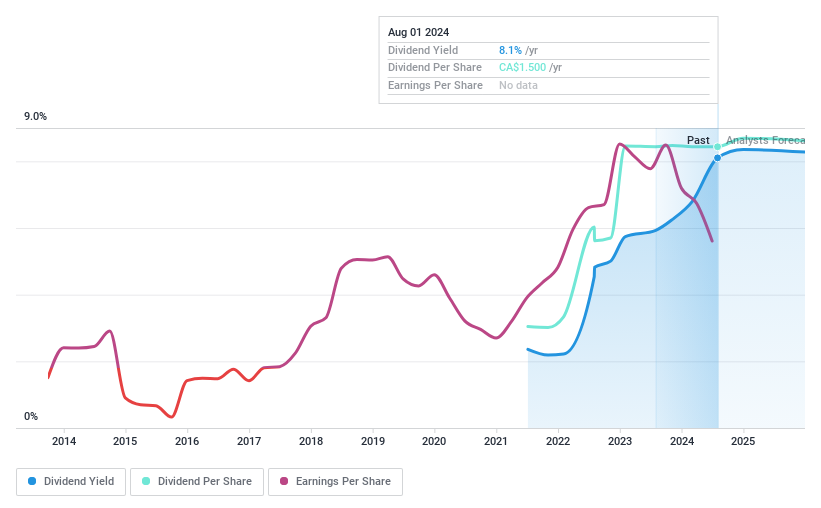

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited, with a market cap of CA$1.67 billion, develops enterprise software solutions worldwide through its subsidiaries.

Operations: Enghouse Systems Limited generates revenue through its Asset Management Group (CA$180.88 million) and Interactive Management Group (CA$299.55 million).

Dividend Yield: 3.5%

Enghouse Systems is trading at 53.9% below its estimated fair value and analysts agree that the stock price will rise by 26.1%. The company’s dividend yield stands at 3.45%, which is reliable but lower than the top 25% of Canadian dividend payers (6.16%). Dividends are well-covered with a payout ratio of 65.7% from earnings and a cash payout ratio of 45.8%, indicating sustainability and stability over the past decade, with consistent growth in payments.

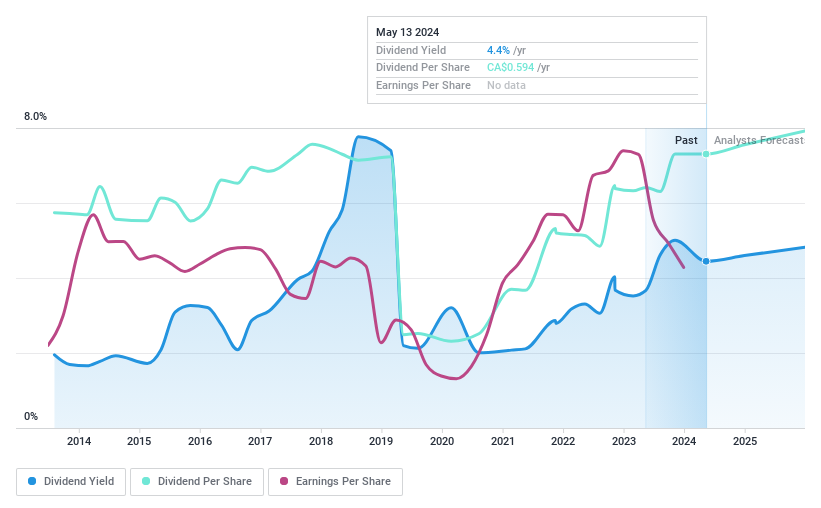

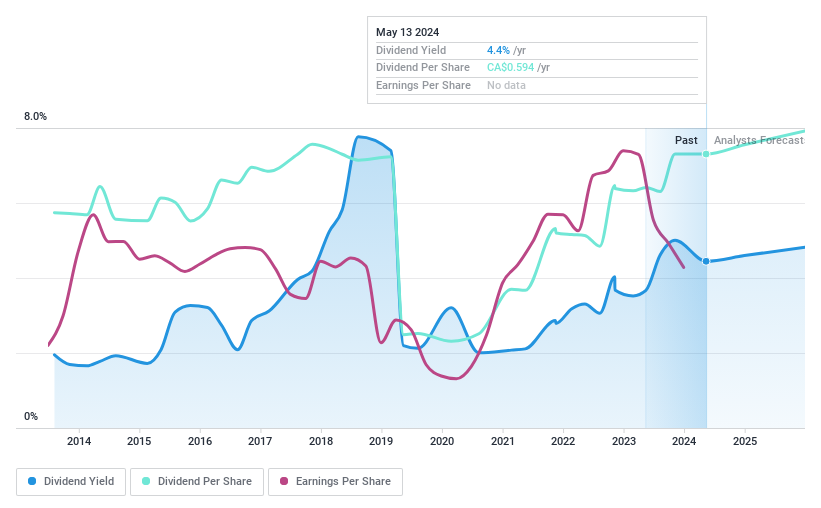

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets frozen seafood products in North America, with a market cap of CA$399.58 million.

Operations: High Liner Foods generates $992.12 million from the manufacturing and marketing of prepared and packaged frozen seafood.

Dividend Yield: 4.5%

High Liner Foods has a low payout ratio of 31.4% and a cash payout ratio of 8.3%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history is volatile, with payments fluctuating over the past decade. Recent earnings showed significant improvement with net income rising to $19.29 million in Q2 2024 from $5.89 million a year ago, despite lower sales ($218.32 million vs $254.35 million). The company also approved a quarterly dividend of CAD 0.15 per share payable on September 15, 2024.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parex Resources Inc. is involved in the exploration, development, production, and marketing of oil and natural gas in Colombia and has a market cap of CA$1.75 billion.

Operations: Parex Resources Inc. generates revenue primarily from its Oil & Gas – Exploration & Production segment, which amounted to $1.21 billion.

Dividend Yield: 8.8%

Parex Resources offers a compelling dividend profile, trading at 38.7% below its estimated fair value with a strong yield of 8.78%, placing it in the top 25% of Canadian dividend payers. Dividends are well-covered by earnings (36.8%) and cash flows (65.8%). Despite only paying dividends for three years, payouts have increased steadily. Recent Q2 results showed revenue growth to US$305.86 million, though net income fell sharply to US$3.85 million from US$101.42 million a year ago.

Where To Now?

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ENGH TSX:HLF and TSX:PXT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com