United Parcel Service (NYSE: UPS) stock gained an impressive 83% between 2020 and the end of 2021 — benefiting from a shift away from services and in-store shopping toward home delivery. But since the beginning of 2022, UPS is down over 35% compared to a 12% gain in the S&P 500.

Here’s why the high-yield dividend stock deserved to sell off but is worth buying now.

A major slowdown

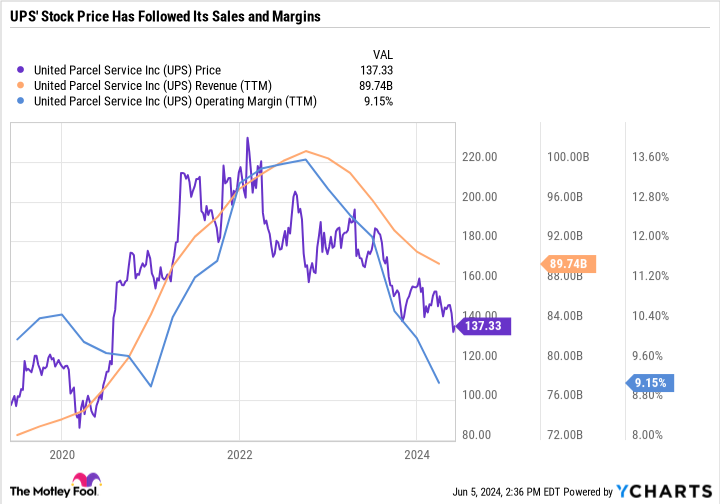

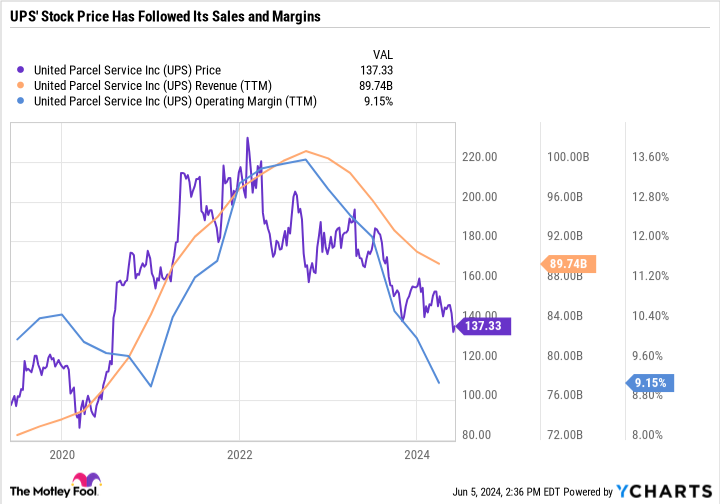

One look at a chart of UPS’ stock price, sales, and operating margin, and it’s easy to see why the stock is hovering around a three-year low.

During the beginning of the COVID-19 pandemic, UPS’ high-margin business-to-business volumes plummeted. However, demand for residential package deliveries soared, leading to rapidly rising revenue. As the business environment recovered, UPS entered a golden period of revenue growth and rising margins. In the chart, you can see the stock price peak in early 2022, with revenue and operating margins peaking later that year.

The last two years have been very difficult for UPS for reasons within and outside its control. The company’s most damaging decision was to overexpand its routes in anticipation of sustained growth in the U.S. small package market. Unfortunately, UPS’ forecast badly missed reality, as the pandemic-induced surge in package delivery volume proved short-lived.

UPS has revised its forecast, expecting a 5.5% compound annual growth rate in average daily volume between 2023 and 2026. Based on that growth rate, it expects to grow revenue to a range of $108 billion to $114 billion by 2026 and reach an adjusted operating margin of at least 13%. In other words, it expects an adjusted operating margin similar to the peak from late 2021 and 2022, paired with higher revenue.

A key part of UPS’ growth plan is healthcare. UPS expects healthcare revenue to double by 2026, thanks to organic growth and acquisitions. UPS is making a big bet on this segment, and it’s important to understand that its medium-term targets largely hinge on the success of healthcare. Monitoring the segment’s performance in UPS’ quarterly financials, as well as management’s commentary on healthcare during its earnings calls, can help you determine if the bet is paying off or not going as planned.

Get paid to wait

UPS has set clear medium-term targets and expectations for investors, which is a helpful yardstick by which to judge the company. However, until UPS progresses toward those targets, the stock will likely remain in “prove it mode.” The story has dramatically changed, as UPS went from a company that consistently blew expectations out of the water to falling short of guidance. UPS has run out of slack, and deservingly so.

At times like this, it can be helpful to zoom out and understand what’s driving negative investor sentiment and judge that sentiment within the context of the long-term investment thesis. UPS benefits from a growing economy, both domestically and intentionally. Its push into healthcare, which is both time and temperature-sensitive, makes a lot of sense and is a great way to give UPS an edge over competitors.

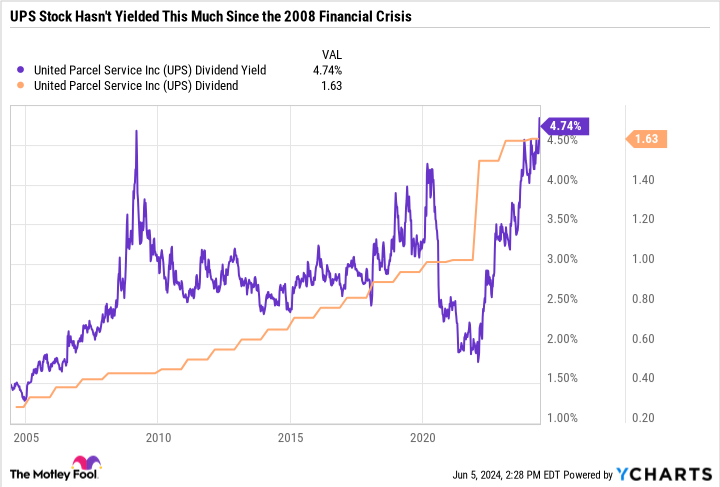

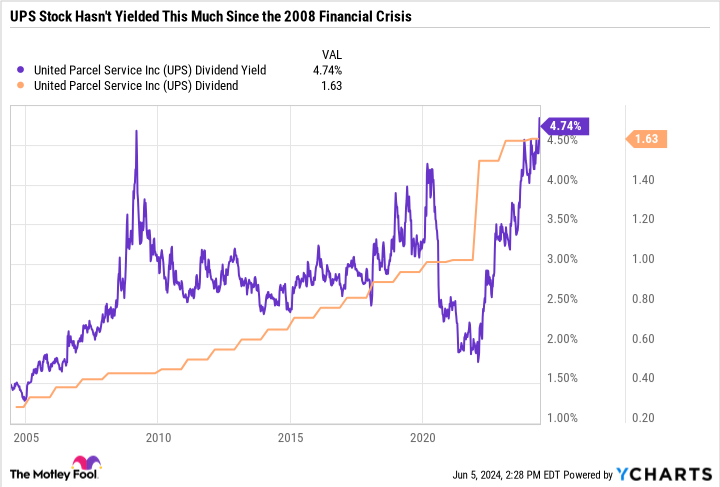

UPS has reached a valuation and dividend yield that are too generous to pass up.

Its dividend yield sits at 4.7% — the most in over 15 years. UPS has also raised its dividend every year for the last 15 years, including a monster 49% raise in early 2022.

In the short term, UPS doesn’t have the earnings growth to justify a growing dividend. However, management’s commentary on the first-quarter 2024 earnings call suggested that UPS would work to keep the dividend steady or slightly raise it and bring down the payout ratio with earnings growth rather than lowering the dividend.

UPS has an adjusted payout ratio target of 50%, meaning it plans to distribute half of the adjusted earnings to shareholders through the dividend. UPS recognizes that it needs to improve its profitability to resume making sizable dividend raises. But in the meantime, the dividend is already quite attractive — especially given the S&P 500 yields just 1.3%.

UPS’ price-to-earnings (P/E) ratio of 19.9 is close to the 10-year median of 20.6. However, UPS’ forward P/E is 16.8 — indicating that analysts expect earnings to improve in the next year.

Consensus analyst estimates call for $8.23 in 2024 earnings per share (EPS) and a whopping $9.82 in 2025 EPS. These are merely projections, so they should be approached with caution. However, at a price per share of around $137.50, UPS looks very cheap if its earnings improve even closer to the forecast pace.

Don’t pass on this passive income opportunity

In today’s expensive market, it can be difficult to find juicy opportunities. But UPS is one of them.

UPS’ inexpensive valuation and high dividend yield provide worthwhile incentives to hold the stock through this challenging time. However, if UPS continues to disappoint and veer off course from its medium-term targets, analysts will likely revise their forecasts, and the stock won’t look like such a bargain.

UPS is a prime example of an out-of-favor stock. It’s easy to spotlight the company’s recent blemishes and blunders, but it’s also a big mistake to discount UPS’ impressive market position and runway in healthcare.

The passive income opportunity and potential for a turnaround outweigh the cons, making UPS a worthwhile, high-yield dividend stock to buy if you’re willing to ride out volatility.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

This Dividend Stock Hasn’t Yielded This Much in Over 15 Years. Here’s Why It’s a Buy Near Its 52-Week Low was originally published by The Motley Fool