Early Friday stock-index futures trading indicate the S&P 500 will start the session several points above the 5,000 mark.

Breaching — and closing above — big round numbers in equity indices inevitably encourages optimists to hope that what was considered resistance can become support.

It can also produce reflections on how the past may give a clue to what comes next. Julian Emanuel, strategist at Evercore ISI, sees a similarity between the Y2K stock market surge of the late 1990’s and today’s market, though he acknowledges the standard caveat: history seldom repeats but often rhymes.

“The unrelenting momentum that has carried the S&P 500 to the round number of 5,000 has few equals in history, the standout example being the internet fueled rally off a similar market bottom in October 1998 versus the pivotal October 2022 low,” says Emanuel in a note sent to clients this week.

To recall, the Y2K phenomenon occurred during the nascent dot-com boom, when some technology stocks got extra propulsion from expectations companies would spend gazillions ensuring their computer systems could switch to 2000 when the new millennium began. Do we have a similar frenzy regarding AI?

Here’s Emanuel’s chart showing the S&P 500’s trajectory from those October lows he’s citing. If the rhyming is rich then today’s market may struggle to make much more headway in this cycle.

Source: Evercore ISI

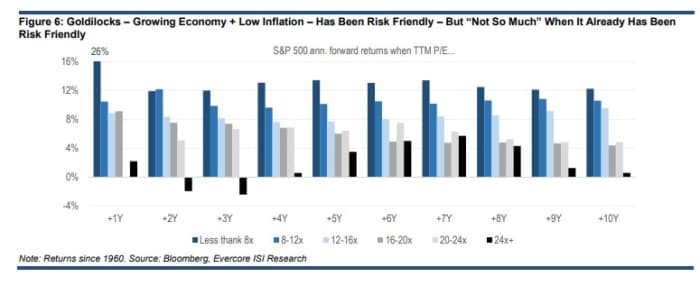

Emanuel is quick to note the differences. Today’s valuations may be stretched at 22 times trailing twelve month earnings, but that’s well below the 28 times seen at the Y2K/dot-com bubble top.

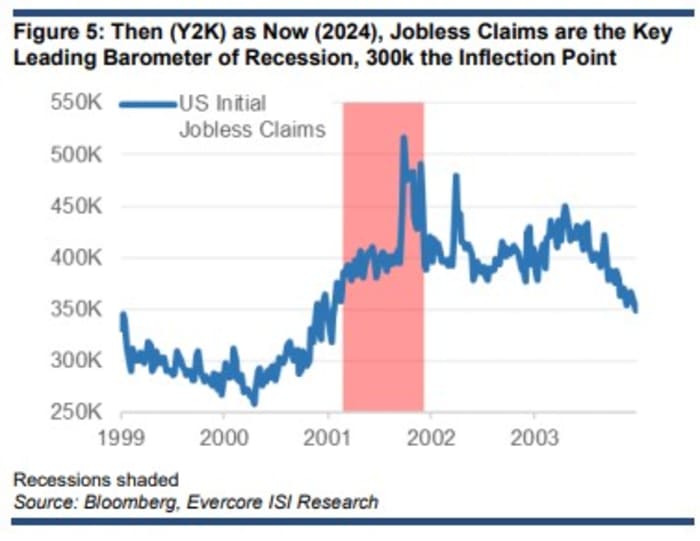

And after the Y2K/dot-com bubble burst in early 2,000 there was a spike in weekly initial jobless benefit claims a full year ahead of the 2001 recession. Current unemployment claims of around 210,000 and stoic consumer confidence data suggests little sign of such stress just yet.

Source: Evercore ISI

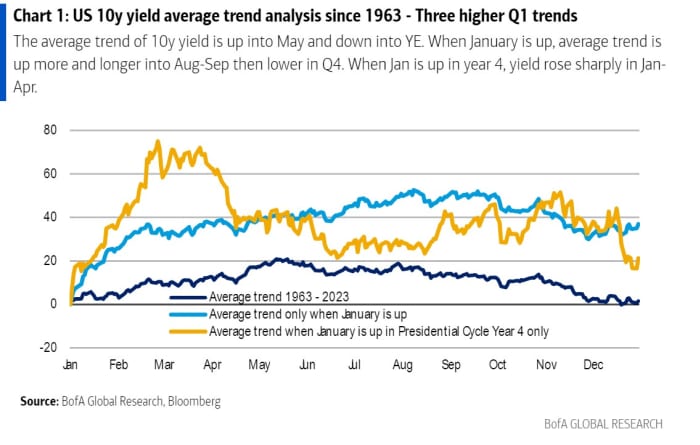

However, he’s still worried by the similarities between now and then. “The price parallels, the positive feeling around the long term potential of generative AI and investors’ new found confidence that money can be made in stocks – as it was in 1999 – despite a 10 year Treasury yield solidly affixed to 4%+, continues to expose equities to inflation, earnings and Fed policy disappointments,” says Emanuel.

Indeed, he thinks the market’s present ‘Goldilocks’ valuation paradigm is consistent with forward average stock returns of zero percent, regardless of whether a recession is averted or not.

Source Evercore ISI

Consequently he favors defense. “We maintain our year end S&P 500 price target of 4,750 and reiterate our preference for communications services, consumer staples, and health care, sectors which have historically outperformed in the time from the Fed’s last hike to the first rate cut,” says Emanuel.

Markets

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

PLTR, |

Palantir Technologies |

|

ARM, |

Arm Holdings |

|

MARA, |

Marathon Digital |

|

TSM, |

Taiwan Semiconductor Manufacturing ADR |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO ADR |

|

GME, |

GameStop |

Random reads

‘My AI boyfriend Is boring me to death’.

Chernobyl’s cancer-resilient mutant wolves.

Turning the air blue. The next stage in ruining football.

American CEOs visiting China can’t escape it: they have to dance on stage.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching. This episode: The start of the AI boom, and one of the Super Bowl’s sweetest stars. Earnings season has Big Tech talking about generative AI. But will chatbots become big business? Plus, we nerd out over the candy relic that went from $50 million to $500 million in annual sales.