Taiwanese companies, led by TSMC, are the world’s foremost manufacturers of logic chips. Taiwan’s semiconductor industry will maintain that lead until at least 2032, according to Yang Ruei-Lin, Director of the Industry, Science and Technology International Strategy Center at the Industrial Technology Research Institute (ITRI), reports TechNews.tw. The Semiconductor Industry Association has made similar predictions.

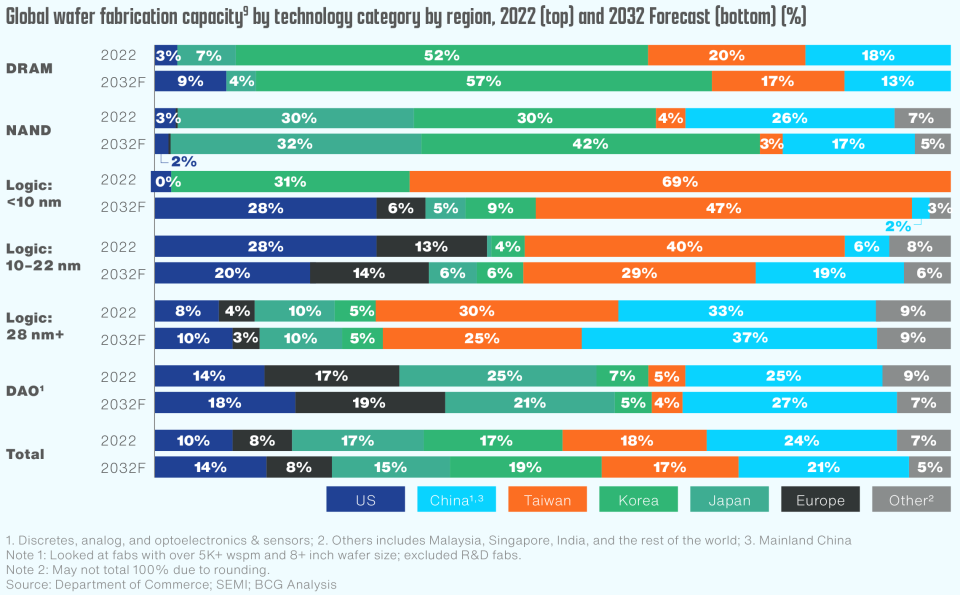

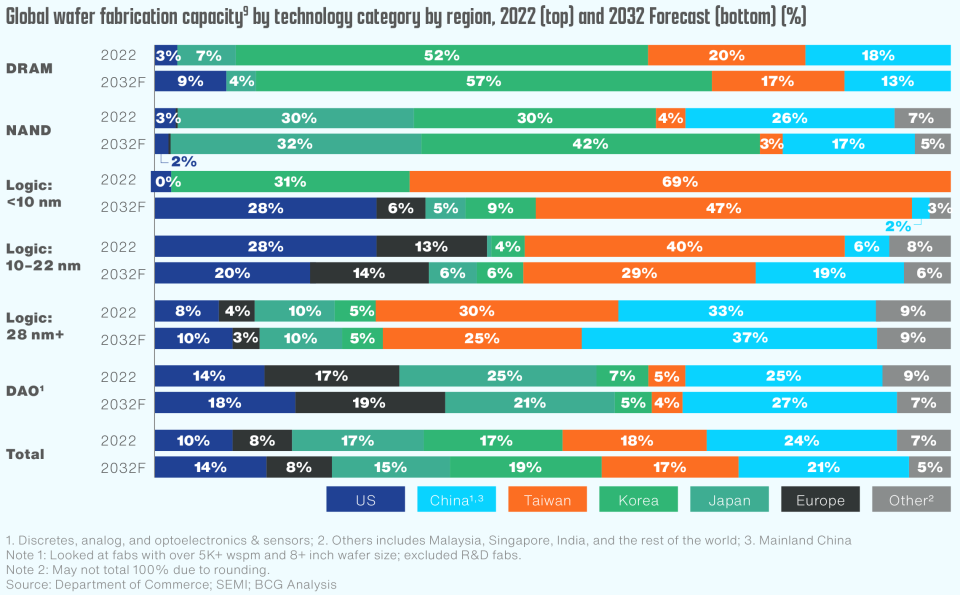

Back in 2022, Taiwan produced 69% of the world’s logic semiconductors using cutting-edge process nodes, mostly for foreign fabless chip designers. This was done on sub-10nm-class nodes, with South Korea accounting for the remaining 31% — Intel didn’t have a sub-10nm node, apparently, as the “Intel 7” rebranding of Intel’s 10nm Enhanced SuperFIN node was still classified as 10nm. For 10nm–22nm nodes in 2022, Taiwan was at 40% followed by the U.S. with 28%. Finally, Taiwan produced 30% of logic on 28nm and older processes, just a little behind China with 33%, according to a report SIA. Based on these figures, Taiwan was the world’s leading manufacturer of logic chips.

With the U.S. government helping chipmakers — including Intel, TSMC, and Samsung Foundry — to build fabs on American soil, production of logic and memory chips in the country will increase substantially by 2032. As a result, it’s estimated that America will produce 28% of sub-10nm chips in 2032. However, Taiwan will maintain lead with 47%, again using data from SIA.

TSMC is set to start volume production on its N2 fabrication process (2nm-class) in the second half of 2025, and it’s estimated that TSMC and Taiwan’s semiconductor industry will maintain its leading position until the advent of 9 angstrom-class technology, which is expected to arrive sometime in 2032.

The upcoming logic semiconductor process technologies will introduce new transistor architectures, and to maintain its lead in the coming years, Taiwan must cooperate internationally, according to Yang Ruei-Lin. Various academia and industry organizations from Europe and the United States are currently investing in such transistor designs as vertically stacked complementary field effect transistors (CFETs). Yang believes that China will also push for breakthroughs in this field to become self-sufficient. Thus, Taiwan needs to engage in international collaboration, enhance research and development security, and incorporate safety mechanisms into its ecosystem.

Hsu Chun-Tzu, Director of CIER Taiwan ASEAN Studies Center, stressed the importance of keeping Taiwan’s vertically integrated semiconductor ecosystem within the country. In light of geopolitical challenges, Taiwan requires a national-level strategy and cross-industry cooperation to develop effective responses.

Geopolitical factors significantly impact the industry, with concerns about Taiwan’s long-term competitiveness due to ongoing tensions. So far, geopolitical factors have both hindered and benefited Taiwan’s semiconductor industry. The primary risk for Taiwan’s leadership now comes from the U.S., which seeks to lessen the concentration of semiconductor manufacturing in Asia by encouraging TSMC to set up production and R&D facilities in the U.S., a move that is not advantageous for Taiwan.

Predicting where things will stand in eight years obviously leaves plenty of room for error. Eight years ago, TSMC had only just begun shipping its 16nm-class node, while Intel started shipping 14nm-class chips in mid-2013. A lot can change in that amount of time, with Intel definitely hoping to acquire a significant piece of the foundry services market. ITRI was founded in Taiwan in 1973, though it now has a woldwide presence. The coming years will certainly be interesting.