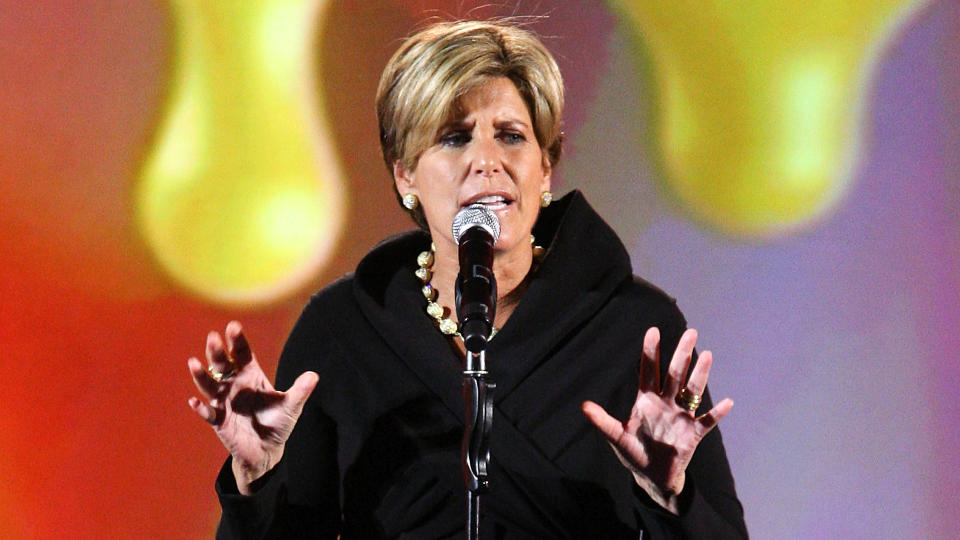

Suze Orman recently offered some advice in a blog post on where to put your money to get a guaranteed high-yield return. However, you need to act sooner rather than later to earn the greatest return on your investment.

Read on for her recommendation for the smartest money move you can make this year — and why the timing matters.

Check Out: 12 Ways To Get Ahead of 99% of People Financially According to ChatGPT

Try This: 3 Genius Things All Wealthy People Do With Their Money

Wealthy people know the best money secrets. Learn how to copy them.

The Smartest Money Move You Could Make This Year

Orman wrote, “Right now, the smartest move you can make is to lock in a safe return of 5% or more for the next year to 18 months.” The investment vehicle she recommends to “get paid a guaranteed 5%” is a certificate of deposit.

Orman explained that fixed interest rates on CDs have steadily climbed over the past few years as the Federal Reserve has increased the federal funds rate, leading to the 5% CD rates currently available at some financial institutions.

Learn More: How To Generate Passive Income With Just $1,000

Why Does Orman Say You Should Make the Move Now?

CD rates crept into the 5.00% annual percentage yield range over a year ago. So why is Orman urging people to invest in CDs now?

It’s because interest rates may be at their peak. The Fed forecasts it will lower the federal funds rate at least once later this year, which means interest rates on new CDs may also decrease. Even if rates only drop slightly, finding CD APYs above 5.00% could become challenging. Right now, the highest APY you can find is around 5.15%.

Why Does Orman Recommend a 12- or 18-Month Term?

Even though some financial institutions offer a 5.00% APY or higher on a six-month CD, Orman specifically mentioned getting a CD with at least a 12-month term. Because CDs have fixed rates, and these rates will likely drop over the next 18 months, the longer you can remain locked into a higher rate, the better.

If you invest in a six-month CD with a fixed 5.00% APY, that rate is guaranteed, even if the Fed lowers rates during those six months. However, when the CD matures, you may no longer find a short-term investment with such a high return when you’re looking to reinvest that money. Because the Fed could lower rates a few times over the next 12 months, locking into a longer-term CD can protect your earning power if interest rates drop.

How Soon Should You Make This Money Move?

The Fed will meet in July, September, November and December and could decide at any of these meetings that a rate cut is necessary.

However, according to many economists, a rate cut will likely not happen until after the September meeting, so now is an excellent time to lock into a CD. If you’re not ready to move your money right away, pay attention to inflation over the next few months and experts’ predictions of when a rate decrease will likely happen.

Is a CD Right for You?

If you have cash in a savings account that you won’t need for the next 12 months, it may be wise to follow Orman’s advice and move it into a CD. However, if that cash is your emergency fund, you may be better off keeping it in a high-yield savings account for easy access, even if it means the account’s variable interest rate may drop one or more times over the next year.

If you must close a CD before its maturity date to cover unexpected expenses, you’ll have to pay an early withdrawal penalty. Depending on the terms of your CD, a penalty could drastically reduce any interest you earn.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Suze Orman: This Is the Smartest Move You Could Make With Your Money This Year