In May, a little over 51 million retired workers took home an average Social Security benefit of $1,916.63, which works out to about $23,000 on an annualized basis. While Social Security payouts aren’t going to make anyone rich, they’ve historically played a key role in laying a financial foundation for America’s aging workforce.

According to an analysis from the Center on Budget and Policy Priorities, this leading program lifted 22.7 million people above the federal poverty line in 2022 — 16.5 million of whom were adults aged 65 and over. Meanwhile, 23 consecutive years of surveys from national pollster Gallup have found that between 80% and 90% of retirees rely on their monthly Social Security income to cover at least some portion of their expenses.

Social Security income is vital to the financial well-being of retired workers, which is why beneficiaries wait on pins and needles for the annual reveal of the program’s cost-of-living adjustment (COLA). While Social Security’s 2025 COLA is on track to do something not seen in 28 years, it’s also poised to disappoint the retired-worker beneficiaries who count on the program most.

How is Social Security’s cost-of-living adjustment (COLA) calculated?

Social Security’s COLA is the mechanism that accounts for changes in the price of goods and services. As a generalized example, if the price for a broad basket of goods and services that seniors regularly buy increases, Social Security checks should (in an ideal world) rise by the same percentage to ensure no loss of purchasing power. COLA is the tool that factors in the inflation (rising prices) or deflation (falling prices) that program beneficiaries are contending with.

There’s been a night-and-day difference in the COLA calculation since the first Social Security retired-worker benefit was mailed in January 1940. For the first 35 years of the program’s history, COLAs were entirely arbitrary and passed along by special sessions of Congress. After no COLAs were doled out during the 1940s, 11 adjustments were passed along between 1950 and 1974.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) became the inflationary tool used to calculate Social Security’s annual COLA. Every spending category within the CPI-W has a specific weighting, which allows this inflationary index to be condensed into a single figure at the end of each month. This makes for easy comparisons to the previous month or year to determine if inflation or deflation has taken place.

The interesting quirk when calculating Social Security’s cost-of-living adjustment is that only trailing 12-month CPI-W readings from the third quarter (July-September) are used in the calculation.

If the average third quarter (Q3) CPI-W reading from the current year is higher the average CPI-W reading in the comparable period of the previous year, inflation has taken place and beneficiaries are due a higher payout. The magnitude of the COLA is determined by the year-over-year percentage increase in Q3 CPI-W readings, rounded to the nearest tenth of a percent.

Social Security’s COLA is on the verge of making history

Following three years of above-average cost-of-living adjustments, Social Security beneficiaries have high hopes that this trend will continue. In 2022, 2023, and 2024, the program’s respective COLAs were 5.9%, 8.7%, and 3.2%, which topped the average COLA over the last two decades of 2.6%.

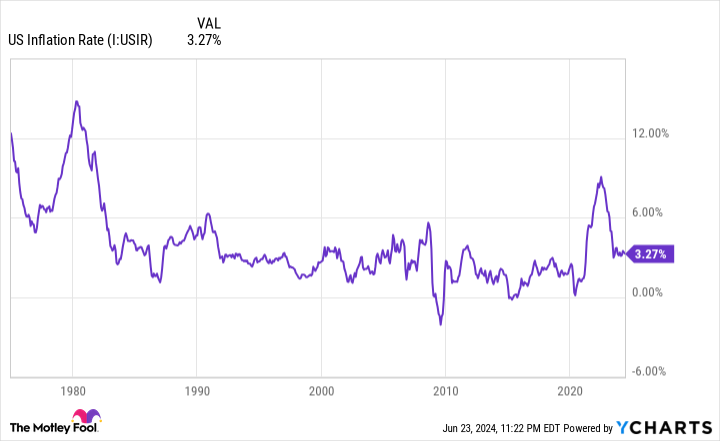

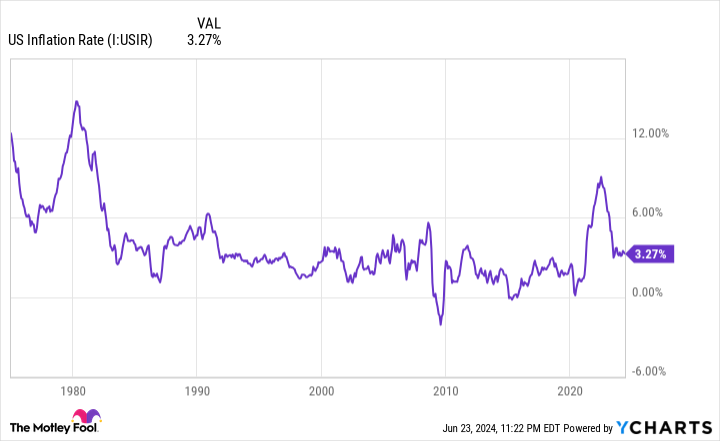

Although we haven’t even reached the ending months that matter in the COLA calculation, the monthly reported CPI-W offers clues as to what to expect. Based on the May inflation report from the U.S. Bureau of Labor Statistics, nonpartisan senior advocacy group The Senior Citizens League (TSCL) anticipates a COLA of 2.57% (which would round to 2.6%) in 2025. Though this is down just a smidge from TSCL’s 2.66% forecast following the April inflation report, it would still mark another year of average or above-average COLAs for program beneficiaries.

Independent Social Security and Medicare policy analyst Mary Johnson, who was previously with TSCL before her retirement, estimates that Social Security’s 2025 COLA will come in at 3%. While this is modestly below her 3.2% COLA forecast for 2025 after the April inflation report, it still suggests another robust increase is on the way.

If Social Security’s 2025 COLA comes in at or above TSCL’s forecast, it’ll mark the fourth consecutive year of COLAs reaching at least 2.6% since 1997. Considering that 10 of the previous 15 COLAs have ranged between 0% and 2%, a minimum COLA of 2.6% is, on paper, a welcome sight.

For those of you wondering, a 2.6% COLA would translate into a roughly $50-per-month increase in the average check of retired workers. Meanwhile, the 3% COLA Johnson has forecast would lead to about a $57-per-month benefit increase in 2025 for retired-worker beneficiaries.

Retired workers are set up for disappointment, once again

With Social Security’s cost-of-living adjustment on track for its fourth consecutive meaningful increase, you’d probably think retirees are all smiles. Unfortunately, this couldn’t be further from the truth.

According to a TSCL analysis, Social Security’s implemented COLAs have come in below the actual rate of inflation in four of the last five years. Based on the May inflation report, 2025 looks as if it’ll mark the fifth time in six years that Social Security’s COLA will lag the prevailing rate of inflation. Per TSCL, the purchasing power of a Social Security dollar declined by 36% between January 2000 and February 2023.

How is it possible that an inflationary index (the CPI-W) can do such a poor job of accounting for the pricing pressures that Social Security recipients are contending with? The answer lies with its construct.

As its full name clearly states, the CPI-W is focused on the spending habits of “urban wage earners and clerical workers.” These are typically working-age individuals who aren’t currently receiving a Social Security check. More importantly, working-age Americans spend their money differently than the seniors who account for 86% of Social Security’s beneficiaries.

The clear-as-day culprit for this dynamic right now is shelter expenses (rent or owners’ equivalent rent). Seniors spend a higher percentage of their monthly budget on shelter than the average working American. That’s a problem when the unadjusted 12-month shelter inflation rate, based on the Consumer Price Index for All Urban Consumers (CPI-U), is a scorching-hot 5.4%! Shelter is also the largest weighted component in the CPI-U and CPI-W.

The crux for the Federal Reserve and seniors is that there’s no quick fix for stubbornly high shelter inflation. The nation’s central bank aimed to tackle historically high inflation head-on with an aggressive rate-hiking cycle, and in doing so has effectively frozen the market for existing home sales. With most homeowners enjoying historically low mortgage rates, the desire to abandon their current home for a mortgage rate of 7% or higher is quite low.

Until shelter expenses move meaningfully lower, or Congress switches away from the CPI-W to a different inflationary measure, this dynamic where Social Security COLAs are insufficient to cover the actual rate of inflation seniors are contending with is likely to perpetuate.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” ›

The Motley Fool has a disclosure policy.

Social Security’s Cost-of-Living Adjustment (COLA) Is Set to Disappoint for a 5th Time in 6 Years, and the Reason Why Is Clear as Day was originally published by The Motley Fool