No event is more anticipated by Social Security’s more than 68 million beneficiaries than the annual reveal of the cost-of-living adjustment (COLA). That’s because most retirees need their monthly Social Security check, in some capacity, to cover their expenses.

For more than two decades, Gallup has conducted annual surveys that gauge retirees’ reliance on Social Security as an income source. This year, for instance, 88% of retirees noted it represented a “major” or “minor” income source, with only 11% responding that it was unnecessary. In other words, most Americans would likely struggle without the financial foundation Social Security provides.

In just 11 days — Oct. 10 is the magic date to circle on your calendar — Social Security’s 2025 COLA will be unveiled. With multiple forecasts now in agreement as to the size of this COLA, we can now estimate how much the average check is expected to rise next year.

Social Security’s COLA serves an important purpose

Before digging into the nitty-gritty of how much Social Security benefits are set to climb in 2025, it’s pretty important to understand what purpose the cost-of-living adjustment serves.

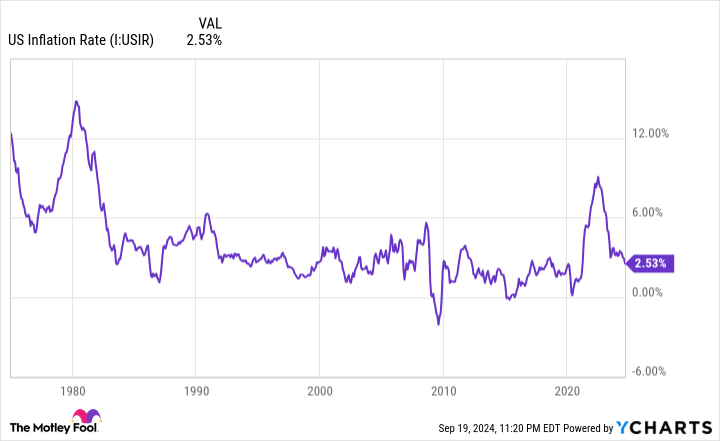

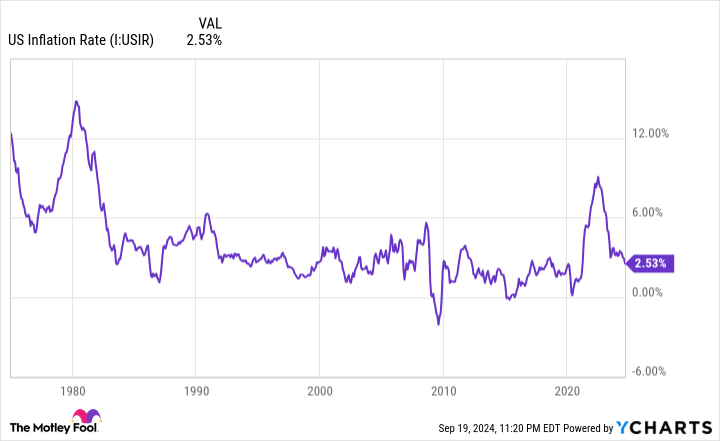

In a utopian world, the price we pay for goods and services would never change, and beneficiaries wouldn’t have to worry about their Social Security income losing buying power. But in the real world, the price of almost everything we buy fluctuates over time, and often heads higher. Social Security’s COLA is tasked with ensuring that beneficiaries don’t lose purchasing power over time.

From the first mailed retired-worker check in January 1940 through December 1974, there wasn’t a set system for assigning COLAs. Rather, arbitrary sessions of Congress passed along COLAs from time to time. Following no adjustments in the 1940s, a record-breaking 77% COLA was passed in 1950.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) took its place as the inflationary tool used to calculate annual COLAs. The CPI-W takes into account the price change of more than 200 goods and services, each of which have their own respective percentage weightings. These weightings allow the CPI-W to be expressed as a single figure each month and make for easy month-to-month and year-over-year comparisons.

Despite the CPI-W being reported monthly, only trailing-12-month readings during the third quarter (Q3), July through September, factor into Social Security’s COLA calculation. Put simply, if the average CPI-W reading in Q3 of the current year is higher than the comparable period last year, prices have collectively risen (i.e., inflation). When this happens, benefits increase the following year.

The magnitude of this increase is simply the year-over-year percentage change in average Q3 CPI-W readings, rounded to the nearest tenth of a percent.

Here’s how much Social Security checks are set to climb in 2025

Forecasts for Social Security’s 2025 cost-of-living adjustment began at opposite ends of the spectrum this year.

In January, the Senior Citizens League (TSCL), a Virginia-based nonpartisan senior advocacy group, estimated Social Security’s 2025 COLA would be a disappointing 1.4%. But after numerous updates, TSCL is now forecasting a 2.5% cost-of-living adjustment for 2025.

On the other hand, independent Social Security and Medicare policy analyst Mary Johnson, who recently retired from TSCL, was forecasting a relatively robust 3.2% COLA following the April inflation report. However, this estimate has declined with each subsequent report and now sits at a TSCL-matching 2.5% for 2025.

Although nothing is set in stone — the September inflation report is the final puzzle piece needed to definitively calculate Social Security’s 2025 COLA — both major forecasts are in agreement on a 2.5% COLA for the upcoming year.

But percentages only tell part of the story. With the assumption that TSCL’s and Johnson’s forecasts prove accurate, let’s take a closer look at how much the average Social Security check is expected to rise in 2025. For this exercise, I’ll be using average payouts for the month of August.

Based on data from the Social Security Administration, the average benefit doled out to its more than 68 million recipients in August was $1,783.55. A 2.5% COLA would result in the average check increasing by $44.59 per month next year.

But this increase could vary significantly, depending on the type of beneficiary:

-

The average retired-worker beneficiary can expect their monthly check to rise by $48.01 to $1,968.49 with a 2.5% cost-of-living adjustment in 2025.

-

For workers with disabilities, a 2.5% COLA would increase the average monthly benefit by $38.50 per month to $1,578.42.

-

Survivor beneficiaries should see their average monthly payout climb by $37.73 to $1,547.09 with a 2.5% COLA.

Although this would represent the smallest COLA on a percentage basis since 2021, it’s still above the 2.3% average COLA passed along over the last 15 years.

Social Security’s COLAs aren’t cutting it for most retirees

Although beneficiaries are on track to receive another (on paper) decent COLA following close to a decade of disappointment — no COLAs were passed along in 2010, 2011, and 2016 due to deflation, and the smallest positive COLA on record was administered in 2017 (0.3%) — the reality for a majority of retirees is that Social Security’s COLAs aren’t cutting it compared to the inflationary pressures they’re contending with.

Based on data from the August inflation report, shelter and medical care service costs have risen by 5.2% and 3.2%, respectively, over the trailing year. Both these expenses matter considerably more to seniors than the typical working American, and they’re increasing at a notably faster rate than the estimated 2025 COLA.

With the CPI-W focused on the spending habits of “urban wage earners and clerical workers,” who are often working-age Americans not currently receiving a Social Security benefit, the stage is set, more often than not, for Social Security benefits to lose buying power.

In mid-July, TSCL published an analysis that found the purchasing power of a Social Security dollar had declined by 20% since the start of 2010. Further, the prevailing inflation rate for a given year has outpaced its assigned COLA in 10 of the last 15 years.

Making matters worse, Medicare’s Part B premium is expected to have yet another scorching-hot increase in 2025. Part B is the section of Medicare responsible for outpatient services.

According to the Medicare Trustees Report, the Part B premium is forecast to rise by 5.9% in 2025 to $185 per month, which would match the 5.9% hike passed along this year. A majority of retired workers aged 65 and over (i.e., the eligibility age for Medicare enrollment) have their Part B premiums automatically deducted from their monthly Social Security check.

If Part B rises at more than twice the rate of the 2025 COLA, it’s a veritable certainty that most retirees will see at least some of their cost-of-living adjustment negated.

Yes, Social Security benefits are set to climb in 2025, but the cost to retirees continues to be far greater than any reward.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Social Security’s 2025 Cost-of-Living Adjustment (COLA) Forecasts Are in Agreement — Here’s How Much the Average Check Is Expected to Rise Next Year was originally published by The Motley Fool