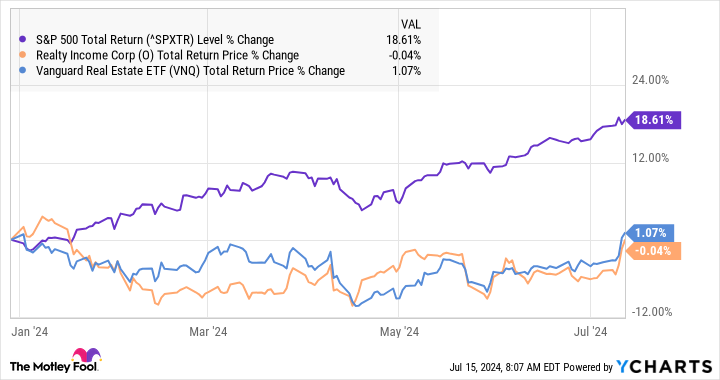

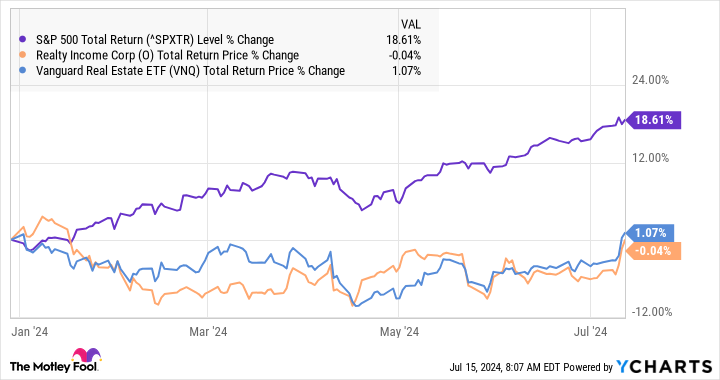

Realty Income (NYSE: O) stock has fallen a bit in 2024, with shares down by 3% for the year as of this writing. Even including dividends, the total return of the real estate investment trust (REIT) is roughly flat.

While there are some legitimate concerns about Realty Income, the business is doing quite well, and it is mostly factors such as interest rates that have put pressure on the stock. Here’s a rundown of why Realty Income has underperformed the market and why it could be set for a turnaround.

Why has Realty Income underperformed?

To be sure, Realty Income isn’t alone. REITs in general have been terrible underperformers in 2024. The Vanguard Real Estate ETF (NYSEMKT: VNQ) has produced a total return of just 1% for the year through July 15, which is 18 percentage points below that of the S&P 500.

The main reason for the poor performance is the rising-rate environment of the past couple of years and specifically the change in expectations for rate cuts compared to the start of 2024. The median-investor expectation was for six Federal Reserve rate cuts at the start of the year, but now the first one isn’t expected to happen until September.

Without getting too deep into the weeds, rising interest rates are generally a negative catalyst for REITs. As risk-free interest rates (like those paid by Treasuries or your savings account) rise, investors tend to rotate money out of riskier income instruments like REITs. Plus, higher rates make it more difficult for REITs to borrow money to fund growth at attractive rates.

Some legitimate concerns

While interest rates have been the dominant force affecting most REITs over the past couple of years, it’s important to note that Realty Income investors have a few legitimate concerns. Specifically, a few of Realty Income’s tenants are facing challenging conditions.

Walgreens (NASDAQ: WBA) is the biggest concern. The pharmacy chain’s CEO recently said that about 25% of its stores aren’t profitable and that the company’s strategic review will “include the closure of a significant portion of these underperforming stores.” Dollar Tree (NASDAQ: DLTR) is also planning to close 600 of its Family Dollar stores in the United States this year.

Realty Income could certainly feel a sting from these events, but it’s important to keep things in perspective. For one thing, although they are among the REIT’s top tenants, Walgreens and Dollar Tree account for 3.4% and 3.1% of Realty Income’s total rental income. Plus, Realty Income’s properties tend to be well-located and high-quality. It’s tough to imagine a scenario where more than 1% or 2% of Realty Income’s total portfolio is affected by store closures in the next few years.

Solid business results

Despite the concerns and interest rate pressures, Realty Income’s business continues to perform quite well. In the first quarter, adjusted funds from operations (AFFO — the real estate equivalent to “earnings”) per share grew by more than 5% year over year. The portfolio remained 98.6% occupied, and the company announced its 124th dividend increase since its 1994 NYSE listing.

It’s also worth noting that because of its superior credit rating, Realty Income is still able to fund growth attractively. For example, it recently issued new debt at a 4.75% interest rate, and the average cash yield from the nearly $600 million worth of properties acquired in Q2 was 7.8%.

The bottom line is that while Realty Income is down by about 30% from its all-time high, much of this is due to temporary interest-rate headwinds. The actual issues affecting its portfolio are likely to be minor. With a 5.7% dividend yield, it could be a great time for investors of all kinds to take a closer look at this reliable income grower.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,989!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 15, 2024

Matt Frankel has positions in Realty Income and Vanguard Real Estate ETF. The Motley Fool has positions in and recommends Realty Income and Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

Realty Income Is Down So Far in 2024 — But Here’s Why I’m Buying Shares Now was originally published by The Motley Fool