Since the advent of the internet in the mid-1990s, investors have patiently waited for the next big innovation to come along that could meaningfully alter the growth trajectory for corporate America. The arrival of artificial intelligence (AI) may be the answer.

Last year, analysts at PwC released a report (“Sizing the Prize”) that estimated the combined consumption-side benefits and productivity gains from AI would add $15.7 trillion to the worldwide economy by 2030. If this forecast is anywhere close to reality, it suggests that a multitude of companies could become big-time winners from the AI revolution.

Thus far, no company has been a bigger beneficiary of the rise of AI than Nvidia (NASDAQ: NVDA) — but this doesn’t mean Wall Street’s AI darling has made all the right moves.

Nvidia quickly became the enterprise data center AI hardware kingpin

Pretty much since the green flag waved, Nvidia’s graphics processing units (GPUs) have been the preferred choice in AI-accelerated data centers. Based on estimates from semiconductor analyst firm TechInsights, 2.67 million GPUs and 3.85 million GPUs were shipped for use in enterprise data centers in 2022 and 2023, respectively. Nvidia accounted for all but 30,000 (in 2022) and 90,000 (in 2023) of these GPU shipments.

Controlling around 98% of the market for the GPUs being used to oversee generative AI solutions and train large language models (LLMs) has afforded Nvidia phenomenal pricing power on its game-changing chips. Whereas Advanced Micro Devices is selling its MI300X AI-GPU for between $10,000 and $15,000, Nvidia’s H100 GPU briefly topped $40,000 earlier this year. Overwhelming demand, coupled with clear-cut GPU scarcity, has led to a melt-up in Nvidia’s adjusted gross margin.

The company’s CUDA software platform has played a key role in keeping businesses loyal to its products and services, too. CUDA is the toolkit that developers use to build LLMs and maximize the potential of their Nvidia GPUs.

Nvidia’s fiscal second-quarter operating results, which detail its activity from April 29 through July 28, demonstrate just how robust demand has been for its ecosystem of solutions. Net sales grew by a scorching-hot 122% to top $30 billion for the quarter, while net income of $16.6 billion (up 168% year-over-year) once again blew past analyst expectations.

But not every decision being made by Nvidia’s management team has, arguably, been the right one.

Nvidia’s $50 billion share repurchase authorization sends the wrong message to shareholders

Let me preface this discussion by not hiding that I’ve been a harsh critic of Nvidia’s valuation and its historic ascent from a $360 billion market cap to a $3 trillion goliath. While recognizing that AI has mass long-term appeal, I stand by my thesis that artificial intelligence is a technology that needs time to mature. I also firmly believe competitive pressures will steadily chip away at the otherworldly GPU pricing power Nvidia has enjoyed.

But my criticism of Nvidia as an investment and company has an entirely new focus today: the $50 billion share repurchase program authorized by its board, as noted in the company’s second-quarter report. This $50 billion comes atop the $7.5 billion remaining from its prior share buyback program.

Most companies authorize share buybacks for two reasons. Firstly, businesses with steady or growing net income that repurchase their stock will often see a lift to earnings per share (EPS). In other words, net income is being divided into a smaller outstanding share count, resulting in higher EPS, which can make a company’s stock more attractive to fundamentally focused investors.

The other reason a company’s board authorizes share repurchases is to demonstrate to investors that it feels its stock is a bargain.

While Nvidia’s $50 billion share repurchase authorization is likely aimed at increasing EPS and instilling confidence in its stock, it sends entirely the wrong message to Wall Street and shareholders for three reasons.

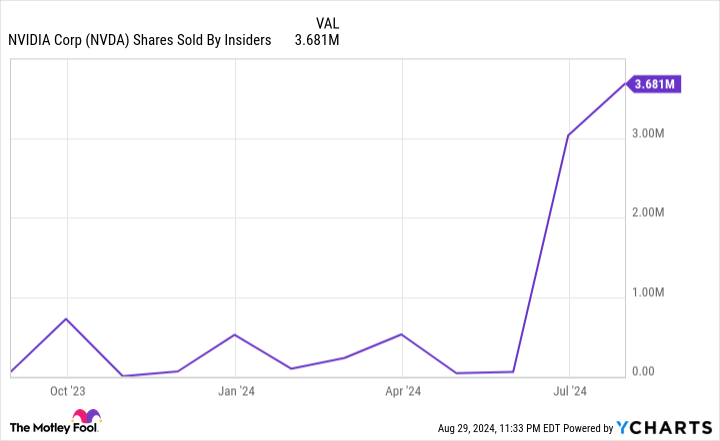

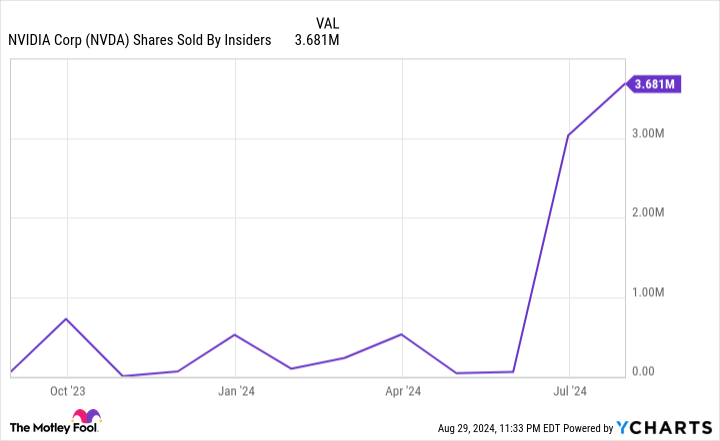

1. Nvidia’s insiders are selling at a torrid pace

The first glaring flaw with this plan is that insider selling activity has never been more pronounced. Between mid-June and mid-August, CEO Jensen Huang disposed of 4.8 million shares of his company’s stock over 20 trading sessions, totaling nearly $580 million.

Moreover, the last time an Nvidia insider purchased a single share of their company’s stock on the open market was December 2020.

The company’s board just authorized a mammoth buyback during a period of unprecedented insider selling activity, which has totaled north of $1.6 billion over the trailing-12-month period. What sort of message does this send when insiders won’t buy a single share on the open market, but the board wants you to believe the company’s shares are still a good value?

2. The company only has $34.8 billion in cash, cash equivalents, and marketable securities

Another reason this $50 billion share repurchase authorization is an epically bad decision by Nvidia is because it ended the fiscal second quarter with “only” $34.8 billion in cash, cash equivalents, and marketable securities in its treasure chest.

To be fair, Nvidia has been a positive cash flow machine in recent quarters, and the company’s share buyback program has no end date. Nevertheless, $50 billion is more of a pie-in-the-sky target than something that’s actually achievable anytime soon.

I’ll also add to this point that $50 billion in share buybacks at Nvidia’s closing price on Aug. 29 would only reduce its outstanding share count by (drum roll) 1.62%! That’s a lot money to have virtually no impact on EPS.

3. Nvidia can’t find a better use for $50 billion while on the leading edge of the hottest innovation?

Lastly, it’s almost incomprehensible that Nvidia is targeting up to $50 billion in additional share repurchases when it’s leading the charge (for now) in data-center AI hardware.

In order to maintain is computing advantage(s) in AI-accelerated data centers, Nvidia will need to aggressively invest in research and development. Although the launch of its next-generation Blackwell GPU architecture is nearing, and CEO Jensen Huang recently teased the Rubin platform, which will be released in 2026, you’d think a game-changer like Nvidia could find a better use for $50 billion on the innovative front than just buying back its stock to, perhaps, increase its quarterly EPS by a few pennies.

With capacity constraints at chip fabricators slowing down Nvidia’s expansion — Nvidia is fabless and outsources its chip production — I’d think a far better use for $50 billion would be to find ways to reduce or eliminate these supply chain restrictions. Acquiring additional capacity or building manufacturing facilities to resolve these issues would make far more sense than a $50 billion buyback program that effectively signals that the board and management team have no better ideas.

It’s looking increasingly likely that Nvidia’s best days are in the rearview mirror.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Nvidia’s $50 Billion Share Buyback Is an Epically Bad Decision That Sends the Wrong Message to Wall Street and Investors was originally published by The Motley Fool