The U.S. economy scored another good grade Thursday, showing stronger-than-expected growth of 3.3% in gross domestic product for the fourth quarter.

President Joe Biden and his allies were quick to celebrate the GDP number, but it’s easy to imagine that it’ll end up as just another economic indicator that doesn’t do much for his job-approval ratings, which have been wallowing around the 40% mark for months.

So what gives? One explanation comes from a research report that was released Thursday by a conservative think tank, American Compass.

“Commentators have expressed befuddlement at the widespread disapproval of President Joe Biden and his economic policies, given the American economy’s strong performance on many traditional measures,” noted the report.

The Biden team’s problem, the report’s authors said, is that it has been emphasizing polarizing policies “where independents are much closer to Republicans, and where strongest support comes from the (much smaller) upper class while strongest opposition comes from the (much larger) working class. This is a formula for political disaster.”

American Compass defines climate

ICLN,

immigration, student loans, safety-net expansion and an unconditional child tax credit as polarizing polices, while it says “broadly supported” issues are drug prices

PJP,

infrastructure

PAVE,

semiconductors

SMH,

competition and tariffs.

The think tank’s chart below shows how those “broadly supported” policies resonated with all types of Americans in a survey conducted by YouGov in late November, while the other issues didn’t click as well with independents and Republicans.

Related: Child tax credit, business breaks gain momentum in Congress

American Compass/YouGov

It’s possible for the Biden White House to change how the country views the president’s handling of the economy, said Oren Cass, executive director of American Compass, in a social-media post on Thursday. Cass said successful politicians pick fights on issues where the bulk of voters are on their side.

“If, as they argue, the fate of the Republic hangs in the balance this November … well, they may want to change course soon,” said Cass, a former adviser to Republican Sen. Mitt Romney’s 2008 and 2012 presidential campaigns.

Other analysts have offered a similar take, including Patrick Murray, director of Monmouth University’s Polling Institute.

“The Biden administration keeps touting their infrastructure investments and a host of positive economic indicators. Those data points may be factual, but most Americans are still smarting from higher prices caused by post-pandemic inflation,” Murray said in a statement last month as his institute released its latest poor marks for the Democratic incumbent. “There is political danger in pushing a message that basically tells people their take on their own situation is wrong.”

There is “certainly an element of partisanship in how people frame their own financial situation,” Murray added, but he said “even a good chunk of Biden’s Democratic base wish he’d start paying more attention to their top priorities than he is now.”

Related: Inflation to stay around 3% because of geopolitical risks, BlackRock says

White House points at improving consumer sentiment, wage growth

Biden administration officials were asked more than once Thursday to explain why the president continues to get low ratings even with encouraging economic indicators such as the latest GDP figure.

“Things don’t just happen overnight here,” said Olivia Dalton, the White House’s principal deputy press secretary, when she got the question during a briefing for reporters aboard Air Force One.

“People have been through a rough period during the pandemic, and this has been three years of a strong recovery, but a recovery,” she added. “Now we’re seeing encouraging signs that consumer sentiment is improving over the last couple of months.”

The University of Michigan’s widely followed gauge for consumer sentiment jumped in January to the highest level since July 2021.

Treasury Secretary Janet Yellen pointed to wage growth when asked Thursday about the “disconnect between very strong economic numbers” and how voters are feeling. That question came from Conagra Brands

CAG,

CEO Sean Connolly during an event hosted by the Economic Club of Chicago.

“Prices for a while increased more than wages. Now the opposite is true,” Yellen said. “Wages are now increasing at a faster rate than inflation. People are getting ahead. They’re seeing their fortunes improve, and I believe if inflation stays low, they’ll begin to regain their confidence in the economy.”

Following Thursday’s GDP data, Biden said in a statement that there now has been “three years in a row of growing the economy from the middle out and the bottom up on my watch.”

“But our work is not done. I will continue to fight to lower costs — from implementing historic legislation to lower prescription-drugs costs, health-insurance premiums, and clean-energy costs, to taking on hidden junk fees that companies use to rip off consumers, to calling on large corporations to pass on to consumers the savings they have been seeing for months now,” the president added. “And I won’t allow extreme Republicans to hand out massive giveaways to the wealthy and large corporations

SPX,

while raising your costs and cutting Social Security, Medicare, and Medicaid.”

Biden’s allies in Congress offered similar statements on the GDP reading, with some taking a shot at his likely opponent in the 2024 presidential election, former President Donald Trump.

“With last year’s numbers, average annual GDP growth for the first three years of the Biden administration comes in at 3.4 percent, far outpacing the 2.6 percent during the first three years of the Trump administration,” said Democratic Rep. Brendan F. Boyle of Pennsylvania. “While Republicans sow chaos, play political games and fight for the attention of Donald Trump, Democrats are delivering for the people.”

Related: Trump beats Haley in New Hampshire — here’s how quickly he could lock up the nomination

Democratic Sen. Martin Heinrich of New Mexico, who chairs the Joint Economic Committee, said: “Overall, the economy is better for American families today than it was a year ago, and it is better today than it was three years ago, before President Biden took office.”

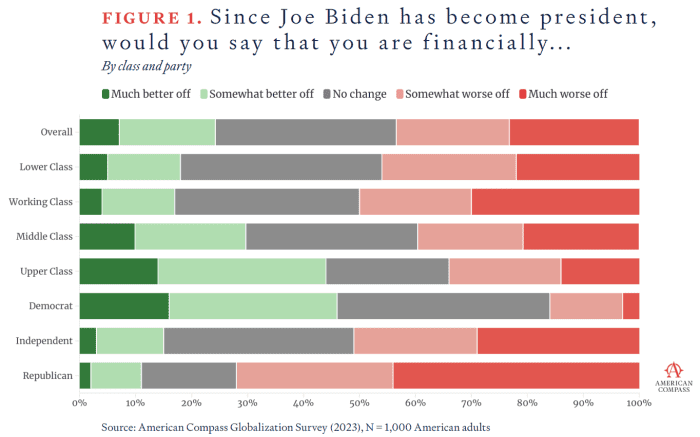

The American Compass/YouGov survey, on the other hand, indicated that even among Democrats, less than 50% said they’re financially somewhat better off or much better off since Biden’s inauguration. For independents and Republicans, less than 20% said they’re financially somewhat better off or much better off. That’s shown in the chart below.

American Compass/YouGov