Amidst a backdrop of global economic uncertainties and shifting market dynamics, the Swedish stock exchange presents unique opportunities for investors looking to capitalize on undervalued stocks. With discounts ranging from 17.6% to 38.5%, these stocks offer potential for considerable gains in a market environment where value investing is becoming increasingly attractive. In the current climate, a good stock often embodies robust fundamentals coupled with an attractive valuation that has not yet been fully recognized by the market. This combination can be particularly compelling in times of economic flux, where discerning investors can identify and invest in stocks poised for recovery or substantial growth.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Gränges (OM:GRNG) |

SEK136.70 |

SEK260.82 |

47.6% |

|

Husqvarna (OM:HUSQ B) |

SEK74.88 |

SEK143.42 |

47.8% |

|

Nordic Waterproofing Holding (OM:NWG) |

SEK160.60 |

SEK313.50 |

48.8% |

|

Scandi Standard (OM:SCST) |

SEK75.00 |

SEK145.57 |

48.5% |

|

RaySearch Laboratories (OM:RAY B) |

SEK140.00 |

SEK278.40 |

49.7% |

|

TF Bank (OM:TFBANK) |

SEK271.00 |

SEK518.37 |

47.7% |

|

Svedbergs Group (OM:SVED BTA B) |

SEK36.30 |

SEK65.51 |

44.6% |

|

Humble Group (OM:HUMBLE) |

SEK9.94 |

SEK18.61 |

46.6% |

|

Nordisk Bergteknik (OM:NORB B) |

SEK16.70 |

SEK30.75 |

45.7% |

|

Bactiguard Holding (OM:BACTI B) |

SEK70.00 |

SEK132.11 |

47% |

Click here to see the full list of 47 stocks from our Undervalued Swedish Stocks Based On Cash Flows screener.

Here’s a peek at a few of the choices from the screener.

Overview: BHG Group AB (publ) is a consumer e-commerce company operating in Sweden, Finland, Denmark, Norway, the rest of Europe, and internationally with a market cap of approximately SEK 2.69 billion.

Operations: BHG Group’s revenue is segmented into Home Improvement at SEK 5.32 billion, Value Home at SEK 2.90 billion, and Premium Living at SEK 2.25 billion.

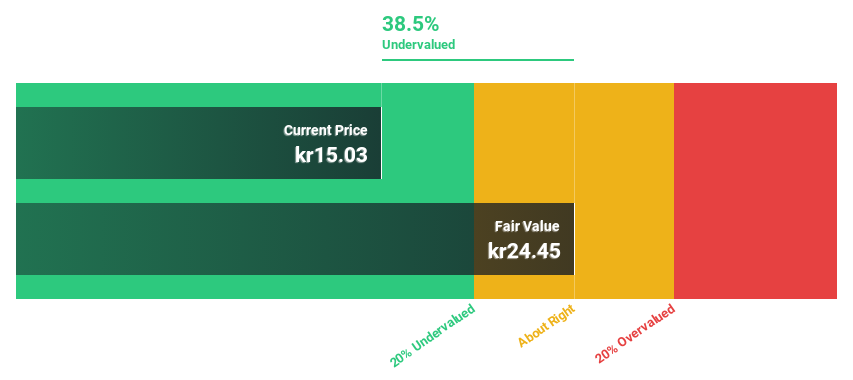

Estimated Discount To Fair Value: 38.5%

BHG Group, despite recent financial struggles with a reported net loss and declining sales, remains an intriguing case for undervalued stocks based on cash flows in Sweden. Currently trading at SEK 15.03, significantly below the estimated fair value of SEK 24.45, it shows potential for substantial growth. Analysts predict BHG will not only become profitable within the next three years but also expect its earnings to surge by a very large margin annually. However, investors should be cautious of its highly volatile share price and low forecasted return on equity at 2%.

Overview: CTT Systems AB, based in Sweden, specializes in designing, manufacturing, and selling humidity control systems for aircraft globally, with a market capitalization of SEK 3.61 billion.

Operations: The company generates its revenue primarily from the Aerospace & Defense segment, totaling SEK 317.70 million.

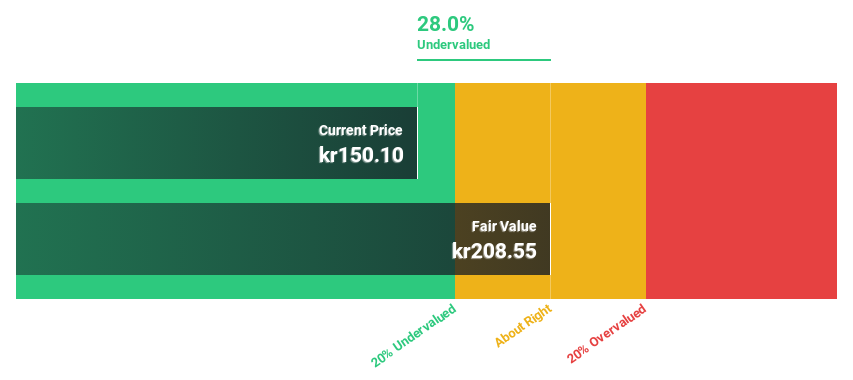

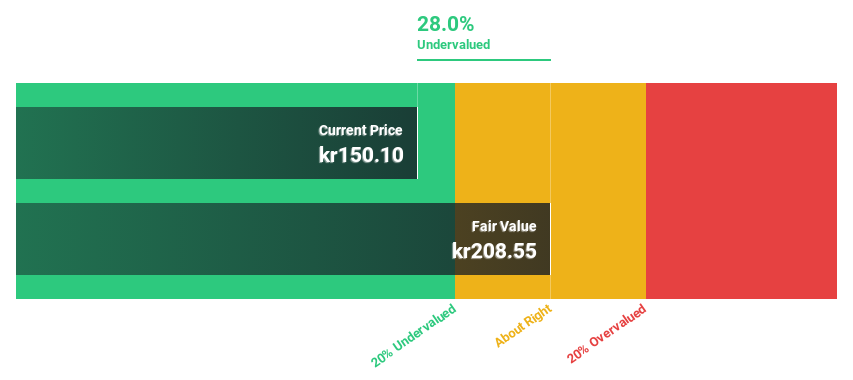

Estimated Discount To Fair Value: 34.9%

CTT Systems, priced at SEK 288, is considered significantly undervalued with a fair value of SEK 442.14, reflecting a 34.9% discount. The company’s earnings and revenue growth forecasts surpass the Swedish market average, expected at 24.8% and 21.9% annually respectively, compared to market growth rates of 15% and 1%. Despite these strong growth prospects and a very high forecasted return on equity of 44.4%, CTT has an unstable dividend track record which may concern some investors.

Overview: Sweco AB (publ) operates globally, offering architecture and engineering consultancy services with a market capitalization of approximately SEK 60.95 billion.

Operations: Sweco’s revenue is primarily generated from its operations in Sweden (SEK 8.74 billion), followed by Norway (SEK 3.50 billion), Belgium (SEK 3.97 billion), Finland (SEK 3.67 billion), Denmark (SEK 3.24 billion), the Netherlands (SEK 3.00 billion), the UK (SEK 1.47 billion), and Germany & Central Europe (SEK 2.71 billion).

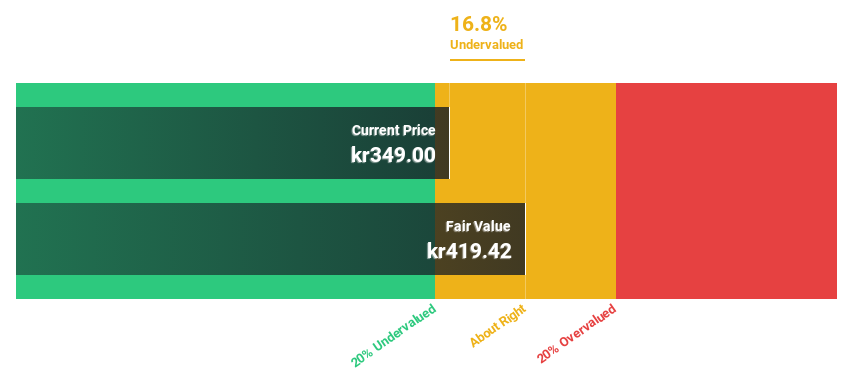

Estimated Discount To Fair Value: 17.6%

Sweco, trading at SEK 169.4, is currently valued below its estimated fair value of SEK 205.6. This suggests a potential undervaluation based on discounted cash flow analysis. Recent financial results show robust growth with Q2 sales increasing to SEK 8,077 million from SEK 7,249 million year-over-year and net income rising to SEK 540 million from SEK 357 million. Additionally, Sweco’s earnings are projected to grow by 17.3% annually over the market’s expected growth of 15%. However, the company has an unstable dividend track record which could be a point of concern for yield-focused investors.

Seize The Opportunity

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BHG OM:CTT and OM:SWEC B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com