Dividend Kings are an elite category of companies that have paid and raised their dividends for at least 50 years. It’s an honorable title. But not all Dividend Kings have what it takes to pay and raise their dividends for the next 50 years.

Illinois Tool Works (NYSE: ITW) stands out as one the highest-quality Dividend Kings. It’s the elite of the elite when it comes to growing payouts to investors. But its stock is down year to date and has sold off after its recent earnings report.

Here’s why it stands out as an outstanding stock to buy in August and hold for decades to come.

ITW’s recipe for success

Illinois Tool Works, commonly known as ITW, is an industrial conglomerate that owns dozens of brands serving a variety of end markets. It divides its business into seven segments: automotive original equipment manufacturing, construction products, food equipment, polymers and fluids, specialty products, test and measurement and electronics, and welding.

The products, equipment, and accessories vary by end market. For example, commercial cooking and refrigeration equipment have nothing to do with gears for internal combustion engines and electric-vehicle (EV) propulsion systems. By operating a diversified portfolio of products ranging in size and complexity, ITW is less vulnerable to cyclical slowdowns in a given end market or product category. The conglomerate model can also reduce redundancies and costs across segments and streamline a global supply chain and manufacturing process.

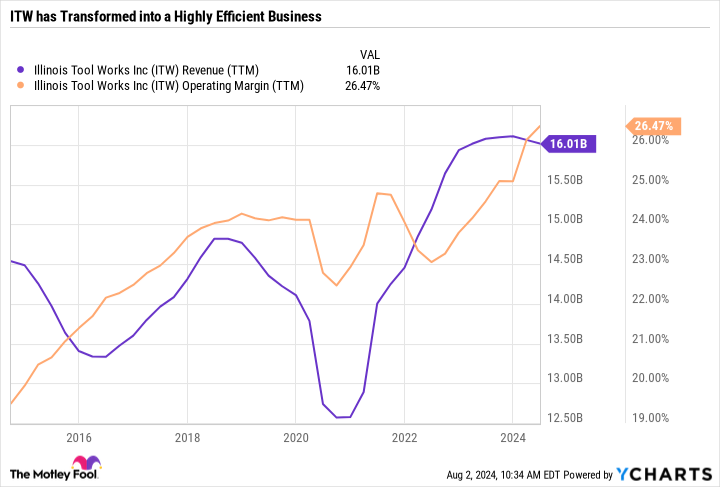

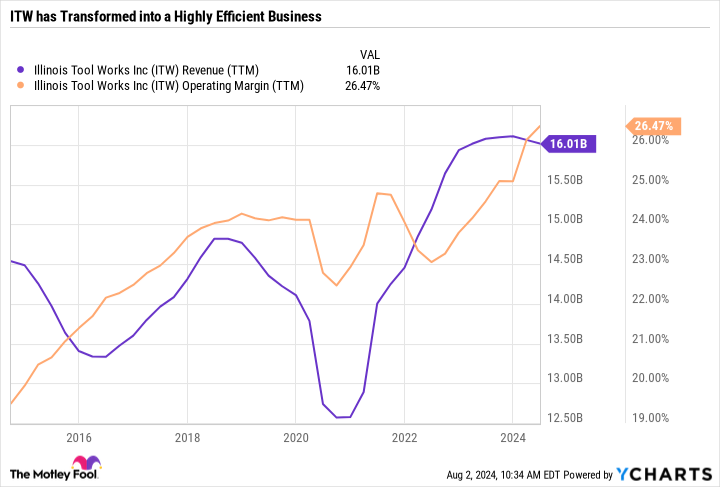

Poorly run conglomerates can lack innovation. ITW, however, is a very well-run conglomerate. It prioritizes margin expansion over sales growth, which has led to steadily rising profits, a growing dividend, and consistent stock buybacks.

ITW’s growth has slowed in recent years — culminating in new guidance for flat organic growth in 2024. As a result, the stock price is languishing at roughly the same price as three years ago.

Despite the weak top line, there are some bright spots worth highlighting. ITW just posted its highest second-quarter operating margin ever and raised its full-year operating margin guidance to a range of 26.5% to 27% and $10.30 to $10.40 in full-year earnings per share (EPS). You’d be hard-pressed to find a similar-sized specialty industrial machinery company with a comparable operating margin.

On the earnings call, management expressed confidence in its ability to continue growing margins. ITW is open to acquisitions if they’re the right fit but won’t settle for anything less than top-notch quality.

In its May 2023 investor day presentation, ITW outlined its long-term goal for 4% to 7% organic revenue growth, based on 1% to 2% market and price growth, 1% to 2% net market penetration growth, and 2% to 3% of customer-back innovation, which is ITW’s term for addressing customer requests and then making products to fill those needs. In response to an analyst question on the earnings call, ITW said that it was even more confident now than during that investor day presentation that it can achieve that long-term growth target.

All told, ITW is enduring a bit of a sluggish period, but nothing about the core business or future plans has changed. Operating margins are at impeccable levels, and the company continues to manage capital well, with a return on capital employed well above historic levels — indicating ITW is doing a good job managing debt and generating profits from capital.

A two-pronged capital-return program

When an investment thesis hasn’t changed but a stock is out of favor, it’s usually a great buying opportunity. If ITW achieves its 2024 guidance of $10.30 to $10.40 in EPS, it would have a price-to-earnings ratio of just 23.4, based on its recent stock price. That’s a reasonable valuation for an excellent business.

ITW’s earnings and cash flow can fund the company’s dividend and a sizable stock-repurchase program. ITW’s payout ratio is just 40%, which means 40% of its earnings are going toward dividend payments. A payout ratio of 50% to 75% would be considered healthy for a business of ITW’s caliber, so there’s room to grow the dividend, even if earnings continue stagnating.

Unlike many Dividend Kings with capital-return programs that are focused almost entirely on dividends, ITW prefers a balanced approach of buybacks and dividends. In the first half of 2024, the company spent $750 million on stock repurchases and $834 million on dividend payments.

Buying back stock can be a good way to grow EPS when organic growth is lagging, and ITW has the profitability needed to make that happen. Although the company yields just 2.5% at recent prices, it’s worth understanding that it could yield roughly twice that much if it reallocated funds used on buybacks toward dividends, instead.

ITW is worth buying and holding

At first glance, ITW looks like a boring business that isn’t worth your hard-earned savings. Sales growth is unimpressive, and there’s a limit to how much margin expansion the company will be able to unlock from here. For context, it’s getting close to its 2030 target operating margin of 30%. Eventually, EPS growth will have to come from somewhere other than improved profitability and buybacks.

The second-quarter earnings call was a vote of confidence that ITW understands what it’s up against and what investors expect. It also validated management’s long-term outlook and how it won’t scramble out of desperation just to put up a good quarter.

ITW has the qualities needed to be a lifelong holding. With a valuation that has only gotten more attractive, the company stands out as a top Dividend King to buy in August.

Should you invest $1,000 in Illinois Tool Works right now?

Before you buy stock in Illinois Tool Works, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Illinois Tool Works wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $638,800!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends Illinois Tool Works. The Motley Fool has a disclosure policy.

Don’t Be Fooled by the Dip — This Dividend King Is a Buy in August was originally published by The Motley Fool