One of the most important gifts that we can pass along to the next generation is a balanced budget. During the Great Moderation of the 1990s, it appeared that we had achieved this goal. The statutory rules enacted by Congress in those years required Congress to bring expenditure into balance with revenues in the near term. With these statutory fiscal rules in place, the country experienced rapid economic growth. After decades of deficit spending and debt accumulation, federal expenditures were brought into balance with federal revenues, and the debt was stabilized.

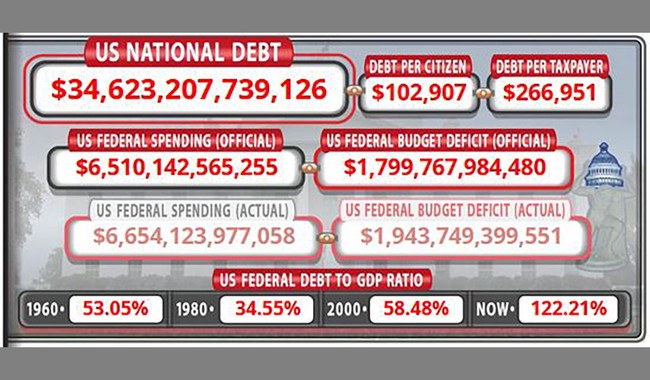

Over the past two decades, however, we have virtually abandoned rules-based fiscal policies. The statutory rules enacted by Congress to balance the budget are routinely suspended or ignored. Deficit spending has increased federal debt in excess of our national income. The Congressional Budget Office (CBO) projects that federal debt will continue to increase more rapidly than national income in coming decades, pushing debt to more than double our national income by midcentury. Both presidential candidates have proposed fiscal policies that will increase debt significantly above the CBO projections. In short, we are about to fall off a fiscal cliff.

A debt crisis is not something that we should leave to future generations. The question is how to restore a Great Moderation in fiscal policy with balanced budgets and debt stability. If Congress is not able to solve the debt crisis, what options do we have?

CATASTROPHE: U.S. National Debt’s Unbelievable Spike Over the Last Three Weeks

Economists’ Top Election Issues Should Put Fear in the Hearts of Democrats

Fortunately, the Founders who drafted the Constitution anticipated just such a crisis. Thomas Jefferson stated that if there was one change he would make in the Constitution, it would be to prohibit federal debt. The Founders were well aware of the bias in Congress toward deficit spending and debt accumulation. They incorporated Article V in the Constitution to provide the states as well as Congress with the power to propose amendments.

Over the years, the states have proposed many amendments to the Constitution without success. Congress is reluctant to surrender its power to propose amendments to the states. When it appeared that the states could reach the two-thirds required to submit an amendment for ratification, Congress preempted that effort by proposing its own amendments.

In 1979, 39 states submitted applications to Congress calling for a fiscal responsibility amendment to the Constitution. That included 30 applications for a fiscal responsibility amendment and nine applications for a general convention. The applications for a fiscal responsibility amendment can be aggregated with plenary applications. Congress, at that point, was bound by Article V of the Constitution to count these applications and call the amendment convention but failed to do so.

In effect, Congress has denied the states their rights under Article V to propose amendments. So far, this breach of the constitutional contract has gone unchallenged. It is time for the states to step up and demand that Congress count state applications and call the amendment convention. State attorneys general and authorized state legislatures should file suit with the Supreme Court for a Declaratory Judgment that would require Congress to count state applications and call the amendment convention.

In order to be ratified, a federal fiscal responsibility amendment must have a two-thirds supermajority in the states for approval. This is a high hurdle, but one that is achievable. There are precedents at the state and national level for citizen approval for constitutional fiscal rules.

For centuries the states have learned to live with the fiscal rules incorporated in their state constitutions. These include balanced budget requirements, tax and expenditure limits, and debt limits. In recent years, other countries, such as Switzerland and Germany, have incorporated fiscal rules in their constitutions limiting deficits and debt accumulation. These countries have been able to bring expenditure into balance with revenues and stabilize debt. It is time for the United States to enact a fiscal responsibility amendment in our Constitution and restore a Great Moderation in fiscal policy.

Barry Poulson is a policy advisor with The Heartland Institute.