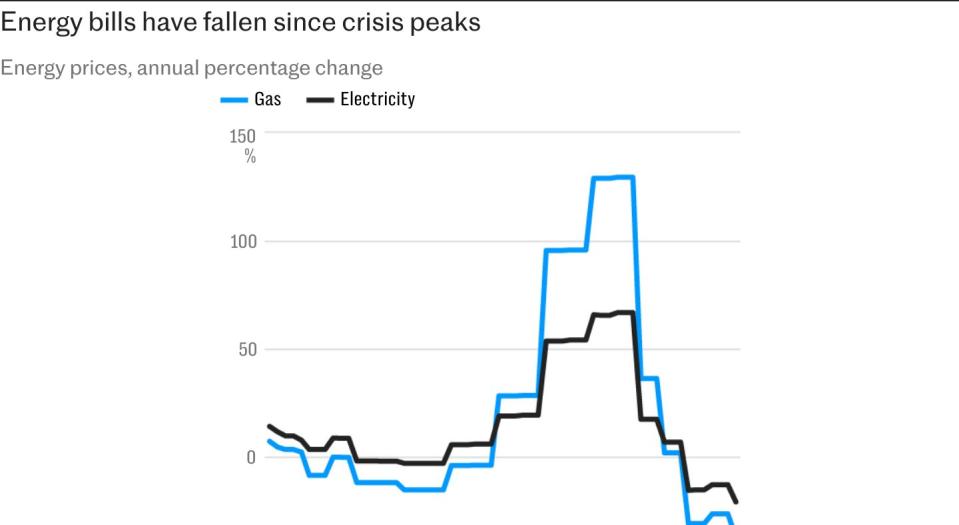

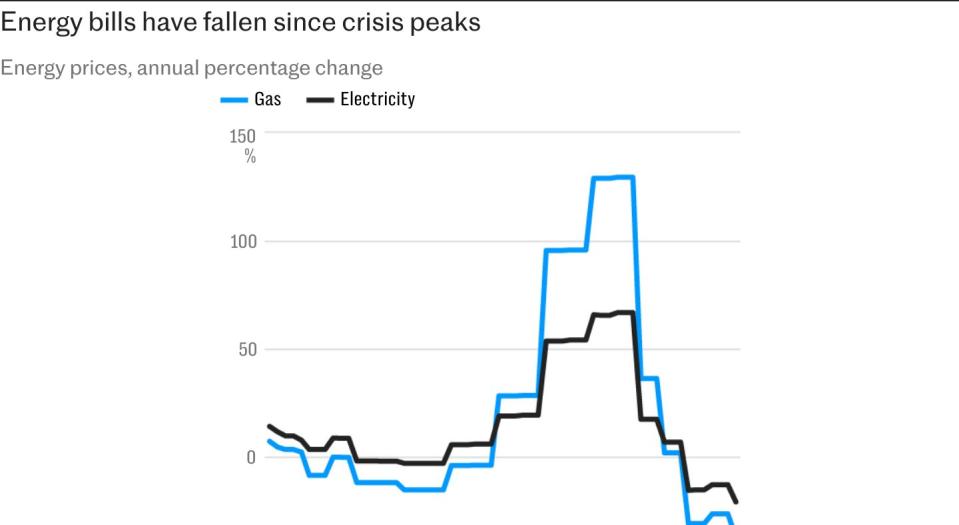

Ukraine’s struggles in the war against Russia will push up energy bills for British families by as much as £190, economists have warned.

Asset manager Columbia Threadneedle Investments has forecast that the energy price cap will jump from its current level of £1,568 to £1,762 in October, resulting in the average family paying £194 more a year.

The prediction is based on recent jumps in energy future contracts, which Columbia’s chief economist Steven Bell said in part reflects the fact that “Ukraine is losing the war”.

Mr Bell said: “There are fears that the storage and transshipment facilities [storage warehouses] in Ukraine of gas are going to come under threat.”

Ukraine’s underground gas storage facilities are the largest in Europe and can hold 31 billion cubic metres of gas.

Mr Bell said concerns about their safety had helped trigger “quite a big move in a few weeks” that had shifted the investor’s assessment of the price cap from below £1,500 to £1,762.

The economist added: “That may not seem like a big increase, but it is 19pc higher than seemed likely a few weeks ago, and 12pc higher than the one we’re currently in. If you are looking for one reason why Rishi Sunak surprised us all by calling an early election instead of November, I think this is it.”

Analysts at Deutsche Bank have similarly predicted that dual-energy bills for British households will rise by 7-10pc from October.

This would lift the energy price cap from its current level of £1,568 to around £1,709 in the final three months of the year.

Chief economist Sanjay Raja said Ukraine’s struggle in the war “certainly could be one contributing factor” to recent market price moves.

Mr Raja added: “Middle East tensions may have also played a role.”

The rise in energy bills threatens to spill over into higher inflation, which has finally returned to the Bank of England’s 2pc target after three years.

Analysts at Nomura have separately warned that markets are underestimating the inflation risks of rising shipping costs as Houthi attacks on vessels in the Red Sea intensify.

High shipping rates could add as much as 0.5 percentage points to inflation by September next year, Nomura said.

The bank warned in a note to clients: “There is a risk that rates may not fall as we currently expect in 2025. In an extremely adverse scenario, there is even the risk that central banks will have to raise rates again.”

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 3 months with unlimited access to our award-winning website, exclusive app, money-saving offers and more.