It’s not just one of the world’s best-known brand names. Coca-Cola (NYSE: KO) has also been — and continues to be — one of the world’s more rewarding investments. Plenty of buy-and-hold investors have become millionaires while sitting on a long-term stake in Coca-Cola stock, well-rewarded for their patience.

The biggest name in the beverage business, however, isn’t the company behind the industry’s most rewarding stock. That honor actually belongs to shares of rival PepsiCo (NASDAQ: PEP).

And the underpinnings of its superior performance aren’t apt to change in the foreseeable future either.

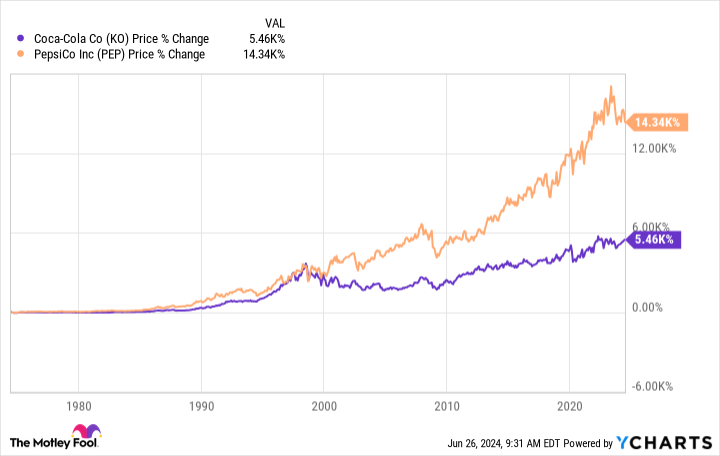

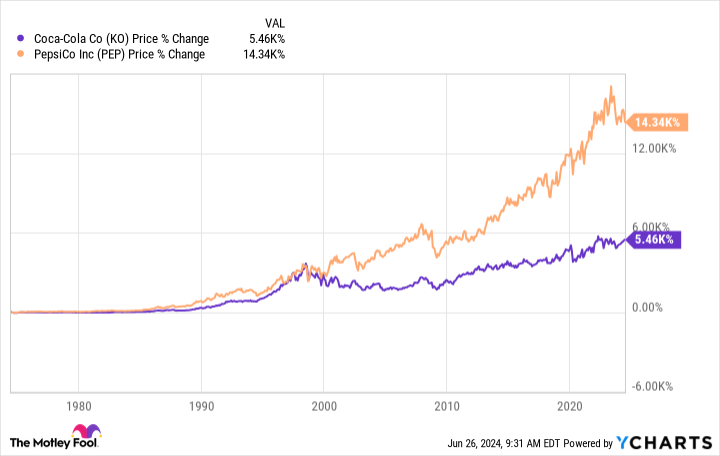

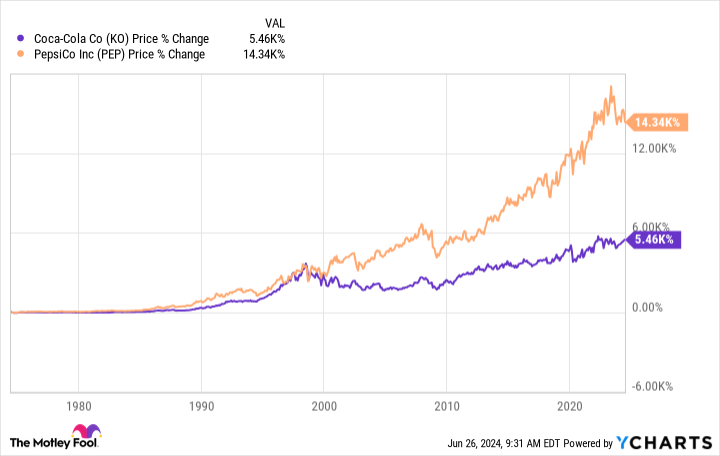

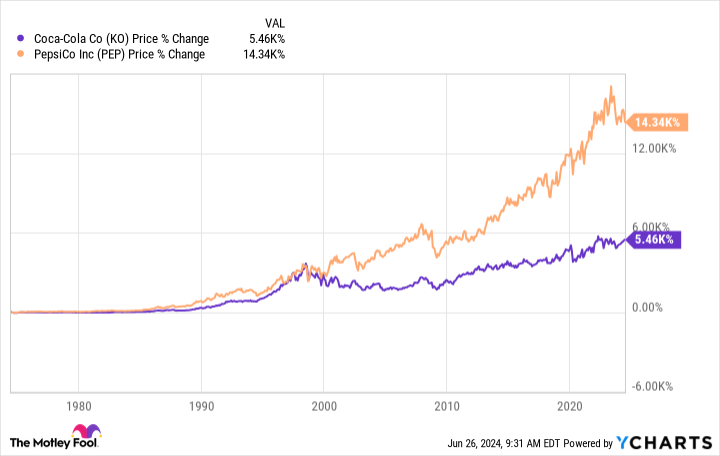

Numbers (and pictures) don’t lie

Surprised? It would be a little surprising if you weren’t. Coca-Cola is viewed by most as the premier name in the drinks business, after all. But, it’s true. Over the past 50 years, PepsiCo’s share price has outgained Coke’s nearly threefold.

Veteran investors will point out that Coke is dividend royalty — literally. It hasn’t just paid a quarterly dividend for decades now. It’s also raised its full-year payout every year for the past 62 years, qualifying it as a Dividend King. As it stands right now only 53 stocks are eligible for the title.

Care to guess one of the market’s other Dividend Kings? If you said PepsiCo, you’re right! It’s raised its total yearly dividends for 52 consecutive years now. While its dividend-growth track record isn’t quite as lengthy, the company’s been upping its payouts at a measurably faster clip.

The big question here, of course, is how? How is PepsiCo able to do what its bigger rival couldn’t for its respective shareholders?

The answer is multifaceted, but it isn’t complicated.

PepsiCo is different than Coca-Cola in all the ways that matter

To fully understand how PepsiCo has achieved the unthinkable, take a step back and look at the bigger picture.

PepsiCo isn’t just a beverage company. Roughly half of its top line is actually driven by its snack foods segment made up of several familiar brand names including Doritos, Rold Gold pretzels, Fritos, Cheetos, and of course, Lay’s potato chips. The North America snack foods division alone accounts for roughly half of the entire company’s operating profits thanks to its far greater profit margins than the highly competitive beverage business could ever support. All told, Frito-Lay’s operating profit margin is consistently in the ballpark of 25% of sales.

Coca-Cola’s operating margin is similar at around 20% of revenue, for the record. But, Coke’s business is distinctly different than PepsiCo’s drinks and snacks operation. Whereas PepsiCo does most of its own bottling and handles the bulk of its own food production, Coca-Cola’s business model is largely royalty-focused — the company punts the bulk of its production work to third-party bottlers that simply purchase Coke’s concentrated syrups and pay franchise fees for the right to distribute its brand-name products.

It’s a high-margin business model to be sure. But its revenue potential is also modest. Although Coca-Cola’s brands of beverages easily outsell PepsiCo’s in terms of the total amount of revenue produced, the company itself only collected $45.8 billion worth of sales last year, turning $11.3 billion of that into operating income. PepsiCo banked greater operating profits of just under $12 billion in 2023, reporting cash flow of $13.4 billion versus Coca-Cola’s $11.6 billion.

No, PepsiCo isn’t producing leaps and bounds more earnings and higher profit margins than its top beverage rival is. The nickels and dimes add up over time, however.

It’s worth adding that while Coke’s royalty/franchise model punts much of the risk of being a bottler to its partner bottlers, it also means Coca-Cola loses a bit of control of the production process. PepsiCo may not like operating its own production facilities, but having complete oversight of them still offers a strategic advantage. One of these advantages is being able to serve as a bottler for other brands including competing soft drink brands like Dr. Pepper, energy drink upstarts like Celsius, as well as juice brand Ocean Spray.

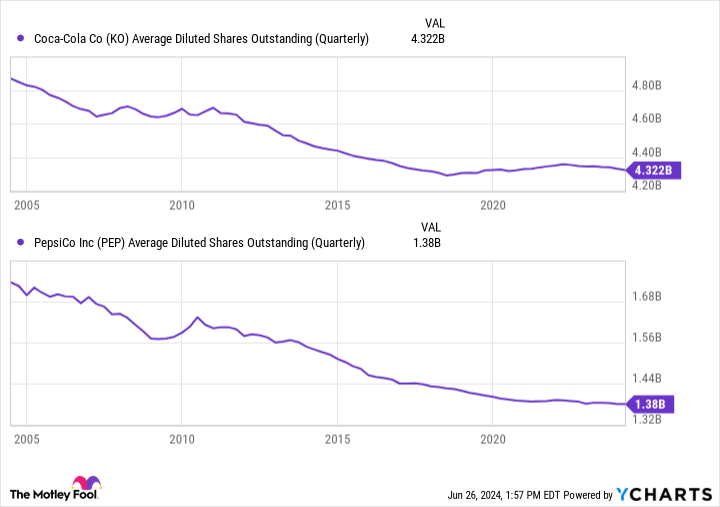

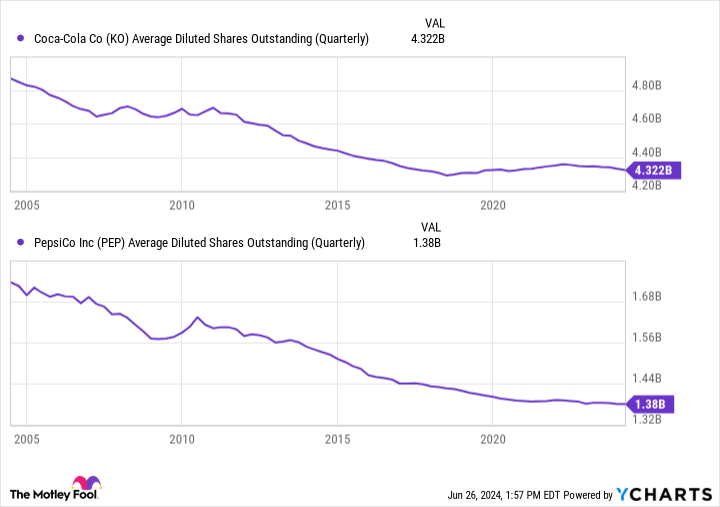

PepsiCo’s stock-buyback and stock-retirement programs are also consistently more shareholder-friendly than Coca-Cola’s. Since mid-2004, PepsiCo has reduced its share count by more than 20%, versus Coke’s reduction of just a little more than 11%.

Just buy PepsiCo stock and forget about it already

Past performance is no guarantee of future results, of course, meaning there’s no assurance PepsiCo shares will continue minting more millionaires than more popular Coca-Cola stock does. Besides, there’s more to stock-picking than mere numbers.

The underpinnings of these two stocks’ different performances are largely rooted in each companies’ products, operations, and corporate ethos though. Those are things that are unlikely to change anytime soon. And PepsiCo’s management certainly doesn’t want them to.

Bottom line? If you’re considering a new position in either of these companies to round out the consumer goods portion of your portfolio, PepsiCo is (surprisingly enough) the better option at this time. That’s particularly true in light of the fact that you’d be plugging in while its shares’ forward-looking dividend yield stands at 3.24% versus Coke’s lesser yield of just over 3%.

Don’t overthink this. More than that though, don’t let your investing judgment be clouded by your personal preference or nostalgia for a particular brand of beverages.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius. The Motley Fool has a disclosure policy.

Forget Coca-Cola: This Stock Has Made Far More Millionaires was originally published by The Motley Fool