The stock market surged over the last year, with the Nasdaq Composite up more than 27% since last June. The growth is a welcome development after the COVID-19 pandemic and an economic downturn in 2022, which saw the same index plunge 33% during the challenging year.

Investors have grown bullish as easing inflation and advances in budding markets like artificial intelligence (AI) could spell a lucrative future for many companies.

As leaders in the consumer market with billions of loyal users, Costco Wholesale (NASDAQ: COST) and Amazon (NASDAQ: AMZN) have promising outlooks. Their stocks are up 61% and 45% respectively over the last 12 months, yet seem nowhere near hitting their ceilings. Costco is expanding rapidly and has barely scratched the surface of its venture abroad. Meanwhile, Amazon’s online retail business is booming alongside heavy investment in AI.

So, here are two soaring stocks I’d buy now with no hesitation.

1. Costco

Costco has come a long way since its founding 40 years ago, when it opened its first store in San Diego, California. The retail giant has won over consumers worldwide with its unique model of offering access to wholesale pricing for the cost of an annual membership.

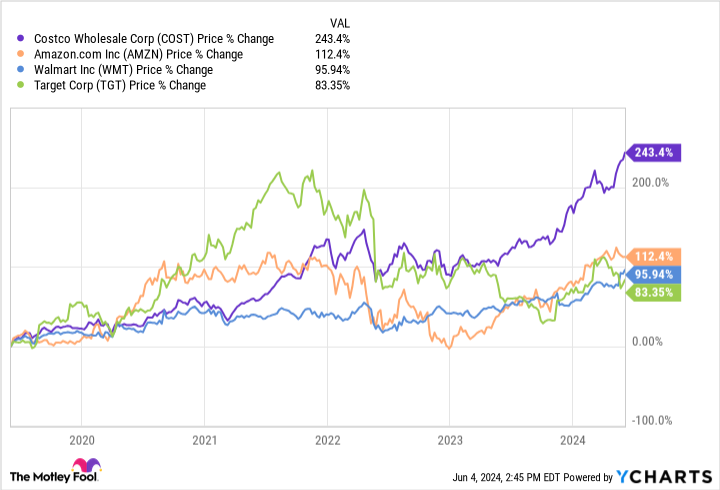

The company’s success has made it one of the best retail investments of the last five years, outperforming rivals like Amazon, Walmart, and Target in stock growth. While past gains aren’t always an indication of what’s to come, recent earnings suggest a lucrative future for Costco.

The retail giant posted its earnings results for the fiscal third quarter of 2024 on May 30. Revenue for the period ended May 12 popped 9% year over year to $57 billion. International sales continued to be its biggest growth driver, with revenue from abroad rising close to 9% compared to 6% domestically.

Costco memberships increased by 8% to more than 74 million in Q3, a promising achievement as its worldwide renewal rate is at 90%. The company boasts 878 locations across 14 countries and is adding more every year.

Costco is on an exciting growth trajectory you won’t want to miss. And with a price-to-sales (P/S) ratio of 1.4, the company’s stock is an excellent value and one I’d buy with no hesitation.

2. Amazon

Amazon has created more than a few bulls over the last year, rallying investors with a booming e-commerce business and an expanding role in AI.

Macroeconomic headwinds in 2022 caused steep declines in consumer spending, with Amazon’s retail sales hit especially hard. However, an impressive recovery has proven the reliability of the company’s business model and its worth as a long-term investment.

Amazon reported its first-quarter 2024 earnings on April 30. Revenue for the quarter increased by 13% year over year, beating analysts’ forecasts by $750 million. However, the most impressive growth came in the form of operating income, which soared 221% to more than $15 billion.

The retail company’s profits skyrocketed over the last year thanks to positive growth in its retail segments and cost-cutting measures. For instance, Q1 2024 saw Amazon’s international segment return to profitability by achieving $903 million in operating income, significantly improving on the $1 billion in losses it posted the year before. Meanwhile, North American operating income increased 454% year over year.

Amazon’s e-commerce segments are rapidly expanding and show no signs of slowing. However, the best reason to consider a long-term investment in Amazon is its highly profitable cloud business, Amazon Web Services (AWS). The platform holds a leading market share in cloud computing, an industry with massive growth potential amid a boom in AI.

In Q1 2024, AWS was responsible for 62% of Amazon’s operating income despite earning the smallest portion of revenue between its three segments. The cloud service gives the company a powerful role in tech and AI and will likely continue to boost earnings for years.

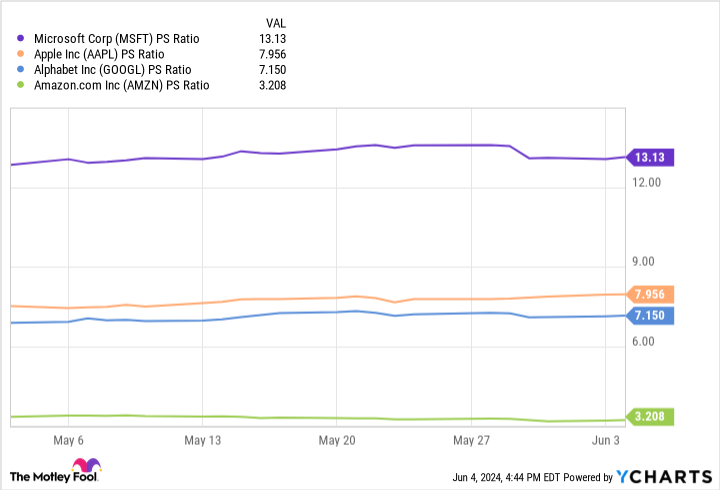

This chart shows Amazon’s P/S is lower than many of its biggest rivals, indicating its stock could be trading at a bargain. That fact, combined with a thriving retail business and a promising position in AI, makes Amazon a no-brainer right now.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $741,362!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Microsoft, Target, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Soaring Stocks I’d Buy Now With No Hesitation was originally published by The Motley Fool