Last week, I took some time to study Berkshire Hathaway‘s quarterly 13F filing, a regulatory report that shows what stocks institutional investors are buying and selling. In the case of Berkshire, I was curious to see what its leader, Warren Buffett, had been up to during the past few months.

During the second quarter, some of Buffett’s more headline-grabbing moves included trimming his position in Apple by nearly half as well as completely exiting artificial intelligence (AI) software company Snowflake.

However, he made another investment that puzzled me at first glance. The Oracle of Omaha’s company purchased 96.2 million shares in satellite radio service Sirius XM (NASDAQ: SIRI), increasing his position by 262%.

To say that Sirius XM has been a clunker for some time would be an understatement. The stock has fallen more than 50% during the past three years, dramatically underperforming the S&P 500‘s 35% gain.

Although I was a little confused by the reasoning here, I’ve come to think that Buffett may have just found his next multibagger opportunity.

Let’s dig into Sirius XM’s business and draw some connections to Buffett’s investment philosophy. After a thorough look at the entire picture, you might come away more aligned with Buffett’s purchase of Sirius XM stock and be inspired to scoop up shares for your own portfolio.

1. Cash flow is king

Sirius XM is not your traditional radio company. Although the company generates some revenue from advertising, the majority of Sirius XM’s sales comes from subscriptions. Subscription-based revenue models tend to command high margins, which can flow straight to the bottom line.

The table below breaks down a number of key performance indicators and financial metrics for Sirius XM over the last year.

|

Category |

2Q23 |

3Q23 |

4Q23 |

1Q24 |

2Q24 |

|---|---|---|---|---|---|

|

Revenue |

$2.2 billion |

$2.3 billion |

$2.3 billion |

$2.2 billion |

$2.2 billion |

|

Income from operations |

$479 million |

$564 million |

$490 million |

$437 million |

$505 million |

|

Gross profit margin |

53% |

54% |

54% |

53% |

54% |

|

Adjusted EBITDA margin |

31% |

33% |

31% |

30% |

32% |

|

Free cash flow |

$323 million |

$291 million |

$445 million |

$132 million |

$343 million |

|

Ending subscribers |

34 million |

34 million |

34 million |

33 million |

33 million |

|

Average revenue per user |

$15.66 |

$15.69 |

$15.63 |

$15.36 |

$15.24 |

Data Source: Sirius XM investor relations.

At first glance, the performance illustrated above doesn’t look great. Sirius XM is experiencing noticeable churn among its subscriber base, which has taken a direct toll on revenue growth — or lack thereof.

However, the company’s average revenue per user (ARPU) hasn’t changed too dramatically during this time frame. By not sacrificing subscription fees, Sirius has been able to maintain and even slightly widen its gross profit margin and earnings before interest, taxes, depreciation, and amortization (EBITDA) margin. Subsequently, the company’s free cash flow has continued to grow — letting Sirius make some new investments in emerging opportunities (more of that below).

A hallmark of Buffett’s investment protocols is identifying businesses with predictable revenue streams that flow to the bottom line. Sirius is a clear example of this dynamic. Although revenue hasn’t been increasing much, Sirius still has an enormous subscriber base that it has been able to profit from consistently. At the end of the day, Sirius still has some pretty strong unit economics despite some blemishes when it comes to revenue growth.

2. Monopolies and moats

Another cornerstone of Buffett’s investment philosophy is identifying companies that have moats. Investors could argue that Sirius XM is essentially a monopoly because the company does not have any direct competition in satellite radio in its core market of North America.

This gives Sirius significant pricing power, since subscribers don’t have many options. It’s this dynamic that helps Sirius maintain its ARPU levels and strong margins despite little revenue growth.

3. A new strategy that could add more customers

Although Sirius doesn’t have direct competitors, the company does face some headwinds. Namely, audio streaming services such as Spotify, Amazon, and Apple all indirectly compete with Sirius. While each of those services offers unique perks and appeals to different demographics, Sirius has been investing heavily in a new strategy that I think is geared toward taking on its larger audio counterparts.

During the past few years, Sirius has acquired podcasts hosted by celebrities and influencers in an effort to broaden its content and appeal to a new range of potential customers. Some of the newer content on Sirius XM’s platform includes Jason Bateman, Sean Hayes, and Will Arnett’s “Smartless” podcast, as well as Team Coco, a media business created by late-night comedian Conan O’Brien.

4. Contrarian investing at its finest

The last pillar supporting my thesis about why Buffett purchased Sirius XM stock revolves around him being a contrarian investor. Contrarian investors might see a lot of value where others see a falling knife. In addition to the business having struggled to acquire new subscribers for some time now, I think investors may be selling Sirius stock for another reason.

Sirius is doing a reverse stock split. Reverse splits often elicit negative sentiment because they are often used as a financial engineering workaround to raise share prices and avoid being delisted from an exchange. In the case of Sirius, though, delisting is far from reality.

The reverse stock split is actually related to the company’s pending merger with Liberty SiriusXM Group. Following the completion of this deal, which is scheduled for Sept. 9, Sirius XM stock will undergo a 1-for-10 reverse stock split. I doubt that most investors actually understand the mechanics of the upcoming merger but are incorrectly assuming that Sirius is doing its reverse split from a position of weakness.

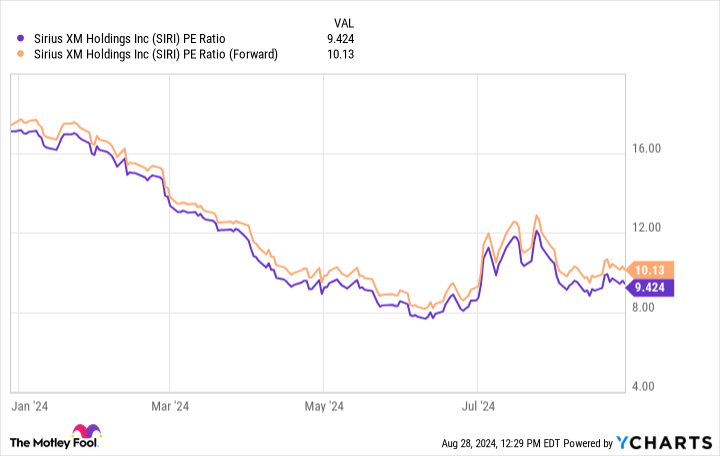

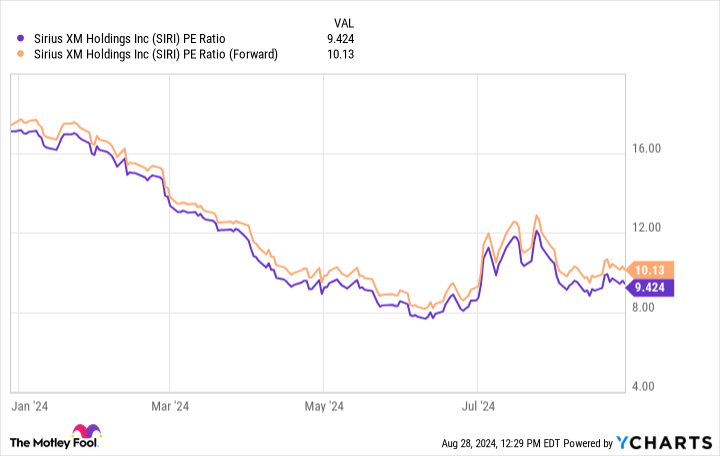

The merger with Liberty SiriusXM Group has been in the works for a while; it was initially announced in December 2023. I do not find it surprising that shortly after the announcement of this deal, Sirius XM’s price-to-earnings (P/E) ratio went into free fall. Furthermore, with a forward P/E of just 10.1 compared to 22.4 for the S&P 500, I’d wager that investors are not too enthusiastic about the company’s growth prospects.

It seems that investors have really soured on Sirius XM and do not see the company as a winning opportunity. But given its beaten-down valuation, consistent cash flow, and investments in new growth opportunities, I can actually understand what may have driven Buffett’s conviction.

Investors who are looking for a potentially underpriced opportunity in an overall financially healthy company might want to follow Buffett’s lead and consider buying shares of Sirius XM before the reverse split occurs next month.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Apple. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Snowflake, and Spotify Technology. The Motley Fool has a disclosure policy.

4 Reasons I Think Warren Buffett Just Increased His Position in This Forgotten Stock-Split Stock by 262% was originally published by The Motley Fool